Payday Loans and Deposit Advance

Products

A WHITE PAPER OF INITIAL DATA FINDINGS

APRIL 24, 2013

CONSUMER FINANCIAL PROTECTION BUREAU

2

Table of Contents

Introduction……………………………………………………………….3 1.

Overview of Payday Loans and Deposit Advances……………….6 2.

2.1 Payday Loans………………………………………………………8

2.2 Deposit Advances………………………………………………...11

Initial Data Findings……………………………………………………14 3.

3.1 Payday Loans……………………………………………………...14

3.1.1. Loan Characteristics…………………………………………..15

3.1.2 Borrower Income……………………………………………….17

3.1.3. Intensity of Use………………………………………………...20

3.1.4. Sustained Use………………………………………………….24

3.2 Deposit Advances…………………………………………………26

3.2.1 Loan Characteristics…………………………………………...27

3.2.2. Consumer Account Characteristics………………………….28

3.2.3. Intensity of Use………………………………………………...32

3.2.4. Sustained Use………………………………………………….38

3.2.5. Deposit Advance Use and Overdraft/NSF Activity….…..…40

4. Conclusion and Implications…………………………………………..43

CONSUMER FINANCIAL PROTECTION BUREAU

3

1. Introduction

During the past year, the Consumer Financial Protection Bureau (CFPB) has engaged in an in-

depth review of short-term small dollar loans, specifically payday loans extended by non-

depository institutions and deposit advance products offered by a small, but growing, number of

depository institutions to their deposit account customers. This review began with a field

hearing held in Birmingham, Alabama in January 2012. At that event, CFPB Director Richard

Cordray noted that “the purpose of th[e] field hearing, and the purpose of all our research and

analysis and outreach on these issues, is to help us figure out how to determine the right

approach to protect consumers and ensure that they have access to a small loan market that is

fair, transparent, and competitive.” Director Cordray went on to state that “[t]hrough forums

like this and through our supervision program, we will systematically gather data to get a

complete picture of the payday market and its impact on consumers,” including how consumers

“are affected by long-term use of these products.”

1

Both at the field hearing and in response to a subsequent request for information, the CFPB

heard from consumers who use these products.

2

On one hand, some consumers provided

favorable responses about the speed at which these loans are given, the availability of these

loans for some consumers who may not qualify for other credit products, and consumers’ ability

to use these loans as a way to avoid overdrawing a deposit account or paying a bill late. On the

other hand, consumers raised concerns such as the risk of being unable to repay the loan while

still having enough money left over for other expenses, the high cost of the loan, and aggressive

debt collection practices in the case of delinquency or default.

These discussions and submissions underscore the importance of undertaking a data-driven

analysis of the use of these products and the longer-term outcomes that borrowers experience.

Because Congress authorized the CFPB to supervise both depository and non-depository

institutions, over the past year we have been able to obtain data from a number of market

1

The full transcript of Director Cordray’s speech is available at http://www.consumerfinance.gov/speeches/remarks-

by-richard-cordray-at-the-payday-loan-field-hearing-in-birmingham-al/.

2

Comments received in response to this request for information are available for review at

http://www.regulations.gov/#!searchResults;rpp=25;po=0;s=cfpb-2012-0009

.

CONSUMER FINANCIAL PROTECTION BUREAU

4

participants that offer either deposit advance products or payday loans. At the same time, the

CFPB has been conducting an in-depth review of overdraft products and practices, which some

consumers may also use to meet financial shortfalls. The CFPB plans to issue a preliminary

report based on the results of that study shortly.

This white paper summarizes the initial findings of the CFPB’s analysis of payday loans and

deposit advances. It describes the features of typical payday loan and deposit advance products.

The paper then presents initial findings using supervisory data the CFPB has obtained from a

number of institutions that provide these products.

3

The analysis reported here reflects

considerations needed to preserve the confidentiality of the institutions that provided the

information used in this paper.

The CFPB has a statutory obligation to promote markets that are fair, transparent, and

competitive. Consequently, this white paper has two primary purposes. First, we seek to provide

information that may facilitate discussion of policy issues around a shared set of facts. Second,

we seek to provide market participants with a clear statement of the concerns our analysis

raises.

The CFPB recognizes that demand exists for small dollar credit products. These types of credit

products can be helpful for consumers if they are structured to facilitate successful repayment

without the need to repeatedly borrow at a high cost. However, if the cost and structure of a

particular loan make it difficult for the consumer to repay, this type of product may further

impair the consumer’s finances. A primary focus is on what we term “sustained use”—the long-

term use of a short-term high-cost product evidenced by a pattern of repeatedly rolling over or

consistently re-borrowing, resulting in the consumer incurring a high level of accumulated fees.

4

3

The CFPB considers all supervisory information to be confidential. Consistent with CFPB’s rules, the data findings

presented in the white paper do not directly or indirectly identify the institutions or consumers involved. See CFPB’s

final rule on the Disclosure of Records and Information, 12 C.F.R. § 1070.41(c).

4

For purposes of this white paper, sustained use is not measured only by the number of loans that are taken by a

consumer over a certain period of time, but the extent to which loans are taken on a consecutive or largely

uninterrupted basis. For example, one consumer who takes out six loans in a year may do so on a sporadic basis,

paying back each loan when due, and taking significant breaks between each use. Another consumer might also have

taken out six loans, but sequentially with little or no break between periods of indebtedness. The latter scenario would

be more indicative of sustained use than the former.

CONSUMER FINANCIAL PROTECTION BUREAU

5

The findings reported in this white paper indicate that these risks exist for a sizable segment of

consumers who use these products.

CONSUMER FINANCIAL PROTECTION BUREAU

6

2. Overview of Payday Loans

and Deposit Advances

Given the general similarities in structure, purpose, and the consumer protection concerns these

products raise, this paper provides a parallel analysis of payday loans and deposit advances.

5

Payday loans offered by non-depository institutions and deposit advances offered by certain

depository institutions are generally marketed as a way to bridge unexpected financial short-

falls between paychecks, receipt of benefits, or other sources of income. The products provide

ready access to funds for a short period of time with very limited underwriting. Rather than

charging a periodic interest rate which would generate a dollar cost that depends on the amount

of time the debt is outstanding, payday and deposit advance lenders charge a set fee that is

based upon the amount borrowed and does not vary with loan duration.

6

Payday loans are typically structured with a single balloon payment of the amount borrowed and

fees, timed to coincide with the borrower’s next payday or other receipt of income.

Loans are

repaid at the storefront or—in the event the borrower does not return to the storefront—

repayment may be initiated by the lender by presenting the consumer’s personal check or

effecting a pre-authorized electronic debit of the consumer’s deposit account.

7

Deposit advances are offered by a small number of depository institutions to certain deposit

account holders who have recurring electronic deposits, such as a direct deposit of their

5

The descriptions of payday loans and deposit advances provided in this section reflect market research and do not

imply that the CFPB has necessarily approved or critiqued any particular aspects of the features or operation of these

products from a regulatory or supervisory standpoint.

6

Some states have minimum loan durations as part of their payday lending laws. Depository institutions offering

deposit advances may have internal policies that affect the minimum amount of time an advance is outstanding.

7

Originally offered only by storefront lenders, these loans are now increasingly offered online. Online payday loans

are discussed in more depth at the end of Section 2.1 on payday loans, but are not the focus of this white paper.

CONSUMER FINANCIAL PROTECTION BUREAU

7

paycheck, to their accounts.

8

Like payday loans, deposit advances are typically structured as

short-term loans. However, deposit advances do not have a predetermined repayment date.

Instead, deposit advance agreements typically stipulate that repayment will automatically be

taken out of the borrower’s next qualifying electronic deposit. Deposit advances are typically

requested through online banking or over the phone, although at some institutions they may be

requested at a branch.

Despite the general similarities between payday loans and deposit advances, particularly in the

consumer protection issues they raise, there are significant differences in delivery costs and

credit risk as those products are typically structured today.

Available data indicate that storefront payday lenders have significant fixed costs associated

with customer acquisition and with the operation of retail storefront locations.

9

Although

storefront lenders generally require borrowers to provide a personal check or debit

authorization, both the credit extensions and loan repayments typically take place at the

storefront. There is less available information regarding the costs of offering a deposit advance

product. However, the product is offered only to existing customers and is an automated feature

of a deposit account, akin to linking a deposit account to a line of credit.

Payday lending also involves somewhat greater credit risk than a deposit advance. The payday

lender is dependent upon information it can obtain from the borrower or from external sources

to assess the borrower’s likelihood of repayment. With deposit advance, the depository

institution has insight into the customer’s flow of funds over a period of time before extending

eligibility to the customer. Furthermore, similar to standard overdraft coverage, depository

institutions can immediately debit incoming funds (certain electronic deposits in the case of

deposit advances) to obtain the repayment of an advance, before paying other transactions that

occur on the same day. Payday industry data indicate loss rates of around 5% of loan

8

We use the term “depository institution” throughout this white paper to generally refer to both banks and credit

unions. “Deposit account” refers to checking accounts offered by a bank and share draft accounts offered by a credit

union.

9

For a more detailed discussion of storefront payday economics, see Flannery, Mark, and Katherine Samolyk, Scale

Economies at Payday Loan Stores, Proceedings of the Federal Reserve Bank of Chicago’s 43rd Annual Conference on

Bank Structure and Competition (May 17, 2007).

CONSUMER FINANCIAL PROTECTION BUREAU

8

originations for large storefront lenders.

10

Initial analysis of loan charge-off rates on deposit

advances conducted by the CPFB in connection with this study suggests that deposit advance

loss rates are lower than those reported for storefront payday loans.

The features and operation of these two products are discussed separately in more detail below.

2.1 Payday Loans

As just explained, a payday loan is typically structured as a closed-end single payment loan with

a due date that coincides with the borrower’s next payday or receipt of other income. Because

the due date is timed in this manner, the loan term is typically two weeks. However, the term

could be shorter for consumers who are paid on a weekly basis or longer for those receiving

income once a month. Variants of this model exist, including open-end lines of credit and

longer-term loans (which may be repayable in installments). The structure of these variations

may be driven by state law or other factors.

A consumer obtaining a payday loan at a storefront location must either provide a personal

check to the lender or an authorization to electronically debit her deposit account for the loan

amount and associated fee. Although the check or authorization essentially serves as a form of

security for the loan, the borrower usually agrees to return to the storefront when the loan is due

to make repayment in person. If the consumer does not return to the storefront when the loan is

due, a lender has the option of depositing the consumer’s check or initiating an electronic

withdrawal from the consumer’s deposit account.

Cost. The cost of a payday loan is a fee which is typically based on the amount advanced, and

does not vary with the duration of the loan. The cost is usually expressed as a dollar fee per $100

borrowed. Fees at storefront payday lenders generally range from $10 to $20 per $100, though

loans with higher fees are possible. Variations often reflect differences in state laws setting

10

For example, one payday trade association notes that “[n]inety five percent of loans are repaid when due...” See

Community Financial Services Association of America, Myth v. Reality, available at

http://cfsaa.com/aboutthepaydayindustry/myth-vs-reality.aspx

.

CONSUMER FINANCIAL PROTECTION BUREAU

9

maximum allowable fees. A fee of $15 per $100 is quite common for a storefront payday loan,

and would yield an APR of 391% on a typical 14-day loan.

Eligibility. Many states set a limit on payday loan size; for example, $500 is a common loan

limit. In order for a consumer to obtain a payday loan, a lender generally requires the consumer

to present identification and documentation of income, and have a personal deposit account.

Lenders generally do not consider a consumer’s other financial obligations or credit score when

determining eligibility; however, some lenders use specialty credit reporting firms to check for

previous defaults on payday loans and perform other due diligence such as identity and deposit

account verification. No collateral (other than the check or electronic debit authorization) is held

for the loan.

Repayment. Storefront payday loan contracts generally require borrowers to return to the

storefront to pay the loan and associated fee by the due date. If a borrower is unable to repay the

full amount, the lender may give her the option to roll over the loan balance by paying a fee,

usually equal to the original finance charge, in order to extend the loan until her next payday. If

the lender is unwilling or—because of restrictions in state law—unable to directly roll over a

loan, the borrower may instead repay the full amount due and then quickly take out a new loan.

Limits on Sustained Use. Historically, payday lending has been largely governed by state law,

often through specific legislation that modifies a state usury law in order to permit payday

lending. Hence, payday lenders are required to comply with varying laws in each state in which

they are located. In states in which payday lending is permitted, laws often include provisions

that attempt to limit sustained use, such as: (1) restrictions on the number of times a loan can

be rolled over, (2) requirements to offer extended payment plans, (3) cooling-off periods

between loans that are triggered after a period of time indebted or number of transactions

conducted, (4) limits on loan size based on monthly income, and (5) limits on the number of

loans that can be taken over a certain period of time. Individual lenders and trade associations

may also adopt their own policies and best practices.

11

11

For example, one trade association whose membership includes storefront payday lenders, the Community

Financial Services Association (CFSA), has adopted a set of best practices that include limits on roll overs and the

availability of an extended payment plan. See CFSA Member Best Practices, available at

http://cfsaa.com/cfsa-

member-best-practices.aspx. Another trade association that also serves storefront payday lenders, the Financial

Service Centers of America (FISCA), has adopted a similar code of conduct for extending credit. See FISCA Code of

CONSUMER FINANCIAL PROTECTION BUREAU

10

Online Payday Lending

While not the subject of the findings of this white paper, the CFPB is separately

analyzing the use of online payday loans. Online payday loans still make up a minority of

the total loan volume; however, the online channel is steadily growing and some industry

analysts believe it may eventually overtake storefront loan volume.

12

Variations on the

loan structure, such as online payday installment loans and open-end lines of credit, are

becoming more common.

In the online lending model, a consumer completes a loan application online and

provides an authorization for the lender to electronically debit her deposit account.

Other payment methods such as remotely-created checks or wire transfers may also be

used. The loan proceeds are then deposited electronically into the consumer’s deposit

account. On the due date, the lender submits the debit authorization to the consumer’s

depository institution for repayment. Alternatively, the loan might be structured to

provide for an automatic roll over, in which event the lender will submit a debit

authorization for the fee only. If an online loan is set up to roll over automatically, the

borrower must proactively contact the lender a few days before the electronic withdrawal

is to occur to indicate that they wish to pay off the loan in full.

Online loans tend to be offered with fees equal to or higher than storefront loans.

According to two industry reports, some of the key cost drivers for online payday lending

are the cost of customer acquisition, often done by purchasing leads from lead

generators, and loss rates which are reportedly higher for online loans than for storefront

payday lending.

13

Conduct in Offering Access to Credit, available at

http://www.fisca.org/Content/NavigationMenu/AboutFISCA/CodesofConduct/FiSCAPDACodesofConduct/default.h

tm.

12

For example, some payday lending industry reports contain discussions of growth trends and loan volume

projections. See, e.g., Stephens Inc. Payday Loan Industry Report (June 6, 2011) and JMP Securities’ Consumer

Finance: Online Financial Services for the Underbanked (Jan. 9, 2012).

13

Cost drivers for the online payday lending industry are also discussed in the Stephens Inc. and JMP Securities

reports, referenced in n. 12.

CONSUMER FINANCIAL PROTECTION BUREAU

11

2.2 Deposit Advances

Deposit advances are lines of credit offered by depository institutions as a feature of an existing

account. The product is available only to those consumers that receive electronic deposits on a

recurring basis. Some institutions provide eligible consumers the option to sign up for this

product; at other institutions, the feature is automatically provided to eligible consumers. When

an advance is requested, funds are typically deposited into the consumer’s account as soon as

the advance is processed, subject to certain limitations on availability for use. Because advances

will be repaid automatically when the next qualifying electronic deposits are made to the

consumer’s account, there is no fixed repayment date at the time the advance is taken. In the

event an outstanding advance is not fully repaid by incoming electronic deposits within 35 days,

the consumer’s account will be debited for the amount due, even if this results in the associated

deposit account being overdrawn.

Cost. Like payday loans, the fees associated with deposit advances typically do not vary with the

time that the consumer has an outstanding loan balance. The fees are typically disclosed to

consumers in terms of dollars per amount advanced. For example, the cost may be described as

$2 in fees for every $20 borrowed, the equivalent of $10 per $100. Unlike a payday loan

however, the repayment date is not set at the time of the advance and will vary depending on

timing and amount of electronic deposits. Hence the fee cannot be used to calculate an APR for

the advance at the time the credit is extended.

Eligibility and Credit Limit. A consumer is eligible for a deposit advance if she has a deposit

account in good standing which has been open for a specified period and has a history of

recurring electronic deposits above a minimum size. Individual depository institutions may

impose additional eligibility criteria. Accounts can become ineligible for additional deposit

advances for a number of reasons, such as a lack of sufficient recent electronic deposits or

excessive overdrafts and non-sufficient funds (NSF) transactions.

Credit limits on the deposit advance product are generally set as a percentage of the account’s

monthly electronic deposits, up to a certain limit. For example, some depository institutions

permit the deposit advance to be the lesser of $500 or 50% of the direct deposits from the

preceding statement cycle. The advance limit does not include any associated fees that may be

charged for the advance.

CONSUMER FINANCIAL PROTECTION BUREAU

12

The depository institution relies on past electronic deposit history to anticipate the level of

deposits that will likely be available as the source of repayment. It typically does not consider the

consumer’s overall outstanding debt service burden and living expenses. Like payday loans,

traditional credit criteria are not used to determine eligibility.

Depository institutions that offer this product generally notify account holders that they are

eligible to take advances through online alerts. An eligible consumer can initiate an advance

online, via automated voice-assisted phone services, or—at some institutions—in person at a

branch.

Repayment. Typically, repayment of an outstanding deposit advance balance is automatically

debited from the consumer’s account upon receipt of the next incoming qualifying electronic

deposit. Qualifying electronic deposits used to repay advances can include recurring deposits

(such as salary or government assistance or benefits) as well as one-time payments (such as a

tax refund or expense reimbursement from an employer).

Generally, the depository institution captures repayment of advances and fees from the

incoming electronic deposit before the consumer can use those funds for other expenses. If that

electronic deposit is less than the outstanding deposit advance balance, institutions will typically

collect the remaining balance from subsequent electronic deposits.

If an advance and the associated fee are not completely repaid through subsequent electronic

deposits within 35 days, the depository institution may execute a forced repayment from the

consumer’s deposit account for the amount due, even if this causes the account to become

overdrawn.

As with payday loans, there are variations of the typical deposit advance product. Some allow

consumers to repay the loan through a series of installments over a period longer than 35 days.

These repayment options may carry additional costs and restrictions.

Limits on Sustained Use. State-chartered depository institutions operate subject to state law,

but, as currently structured, the deposit advance product does not meet the definition of payday

lending contained in most state laws, and federally chartered institutions are not generally

subject to such legislation. Consequently, it appears that depository institutions typically do not

consider such laws in setting the features of deposit advance products. Most programs set limits

on the number of consecutive months a consumer can use deposit advances. However, the

CONSUMER FINANCIAL PROTECTION BUREAU

13

amount of borrowing needed to trigger a cooling-off period or other mechanism to limit use

varies across institutions.

Interplay with Overdraft. Because deposit advance and overdraft are both services tied to a

deposit account, there is potential for various interactions between these products. Depository

institutions frequently consider a consumer’s overdraft and NSF activity when assessing

continued eligibility for deposit advance.

If account balances are depleted, consumers may use a deposit advance to cover debits before

those transactions are posted and thereby avoid incurring overdraft fees. However, if a

consumer’s account is already overdrawn when she takes a deposit advance, the advance

proceeds are automatically applied to pay off the negative balance resulting from the overdraft

and any associated fee first, with the remainder available for her use. In addition, a consumer’s

account may become overdrawn from a forced repayment on day 35 if there are insufficient

funds in the account to cover the repayment. If this insufficient fund situation occurs, a

consumer may be charged overdraft or NSF fees on subsequent items presented to the account.

CONSUMER FINANCIAL PROTECTION BUREAU

14

3. Initial Data Findings

The CFPB’s avenues of inquiry related to the use of payday loans and deposit advances include

loan and borrower characteristics, usage patterns, and outcomes that are correlated with certain

patterns of use. While our data do not represent all consumers using these products, our

findings are an accurate representation of how these products are used by a sizable share of

borrowers in the marketplace.

The following discussion provides initial data findings on consumer usage of storefront payday

loans

14

and deposit advances.

3.1 Payday Loans

For our study of payday loans, we obtained data from a number of payday lenders to create a

dataset of all payday loans extended by each lender for a minimum 12-month period.

Information in the data allows us to identify the loans that were made to the same consumer at a

given lender, but not to the same consumer across lenders.

15

Our findings are derived from a subset of consumers in the full dataset. The sample consists of

consumers who have a loan in our dataset in the first month of a 12-month period and then

tracks usage across this timeframe. We limit our analysis to this subset of consumers because

one focus of our analysis is sustained use, and consumers that we initially observe later in the

data can only be followed for a more limited time. The start and end dates of lenders’ 12-month

14

As noted before, while the analysis in this white paper does not include any online payday loan usage, we plan to

conduct a similar analysis of that market.

15

Our sample consists of all loan activity conducted by an individual consumer at a given lender during the 12-month

time period. A borrower may obtain loans from more than one payday lender; however, this analysis does not control

for such cross-lender activity and thus potentially underestimates per-consumer usage. The impacts of cross-lender

borrowing may be evaluated in subsequent empirical work. In addition, because we are analyzing results for

individuals rather than households, we cannot determine whether other household members are using payday loans

or have other relevant income that is not observed.

CONSUMER FINANCIAL PROTECTION BUREAU

15

data reporting varies, which mitigates concerns about seasonality effects. Overall, the study

sample consists of a total of approximately 15 million loans generated by storefronts in 33

states.

16

3.1.1 Loan Characteristics

The median amount borrowed by consumers in our sample was $350. Loan amounts are often

limited by state law, with a common maximum loan size of $500, though some states have lower

or higher limits. Individual lender credit models may also influence loan amounts offered. The

mean loan size was $392, signaling that there are more consumers with loan sizes substantially

above the median than substantially below. Most loans in our sample cluster around $250,

$300, and $500.

The payday loans we analyzed were single payment loans with a repayment scheduled to occur

on the borrower’s payday (or when they are scheduled to receive other regular sources of

income). We found a median loan term of 14 days, and a mean loan term of 18.3 days.

17

While payday loans are generally characterized as two-week loans, and we observed a significant

number of loans with a 14-day loan duration, there are several explanations for the longer mean

loan duration. One reason is state law, which can dictate minimum loan terms and other

features.

18

In addition, loan due dates are impacted by the frequency at which consumers

receive income, since due dates are generally set to align with a borrower’s payday. We have data

for a subset of our sample on the frequency with which consumers received income, which is

illustrated in Figure 1 below. While over half of the consumers we observed were paid twice per

16

Our sample does not include loans structured at origination to be repayable in installments over a longer period of

time, such as those offered in Colorado. Colorado requires a minimum six month loan term. See Colorado Deferred

Deposit Loan Act, 5-3.1-103.

17

Loan duration is defined as the contractual duration when available. When contract duration is unavailable,

duration is based on the date the loan was repaid. Average duration changes very little if loans for which contractual

duration is unavailable are dropped from the sample.

18

For example, if a consumer who is paid every two weeks takes out a payday loan three days before her next payday

in a state with a minimum seven day loan term, her loan would not come due at that time. Rather, it would be

scheduled for a subsequent payday, perhaps 17 days later.

CONSUMER FINANCIAL PROTECTION BUREAU

16

month (thus receiving 24 paychecks per year if paid semi-monthly or 26 paychecks if paid bi-

weekly), one-third of consumers were paid monthly.

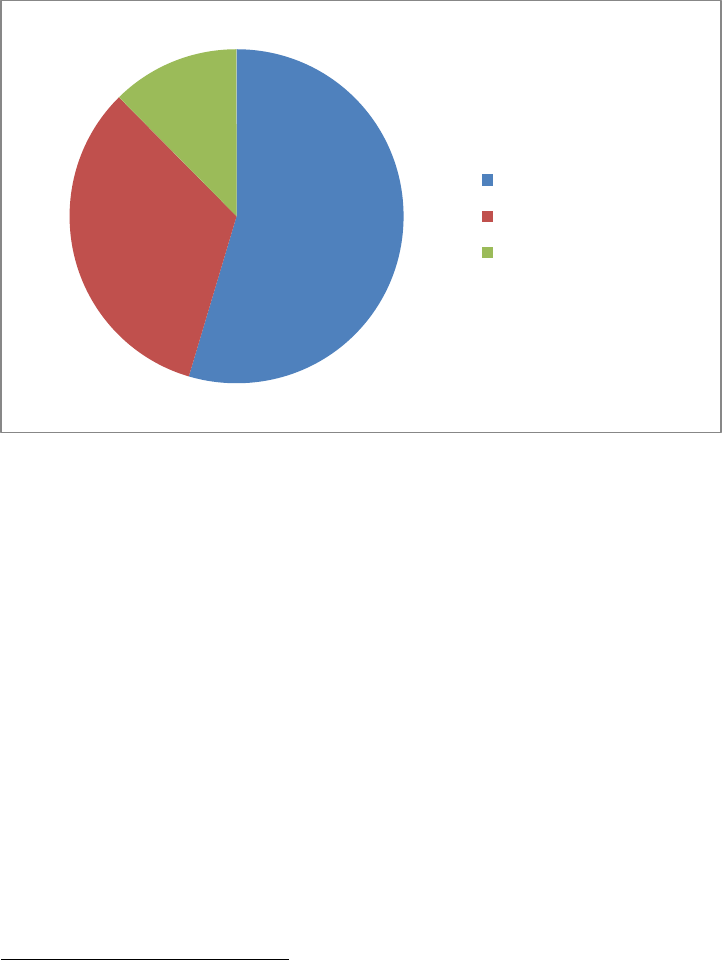

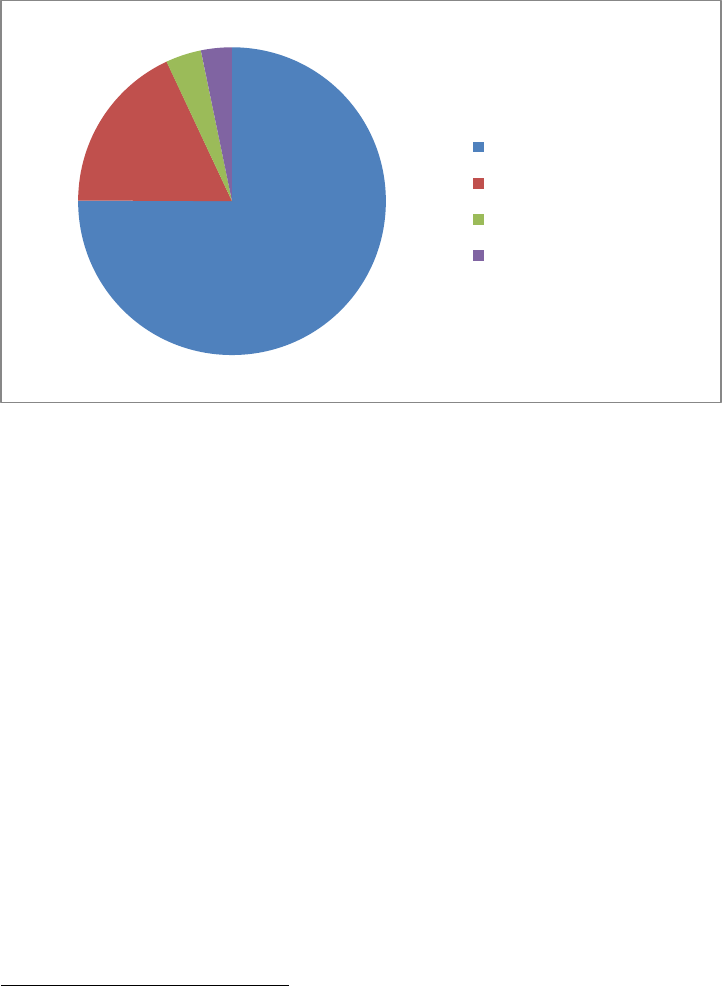

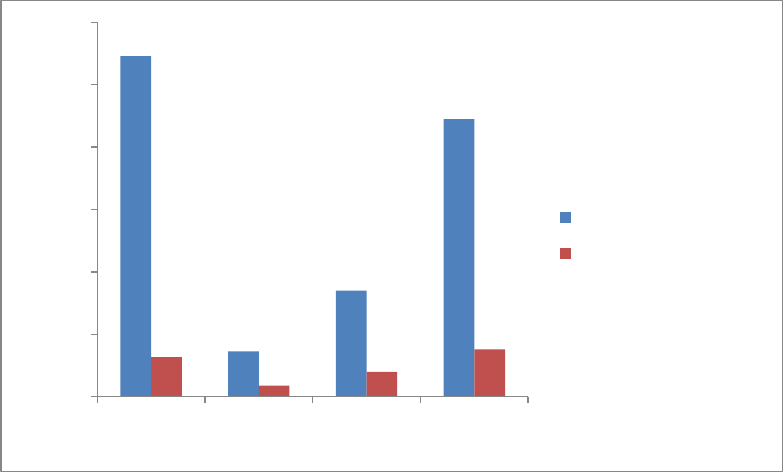

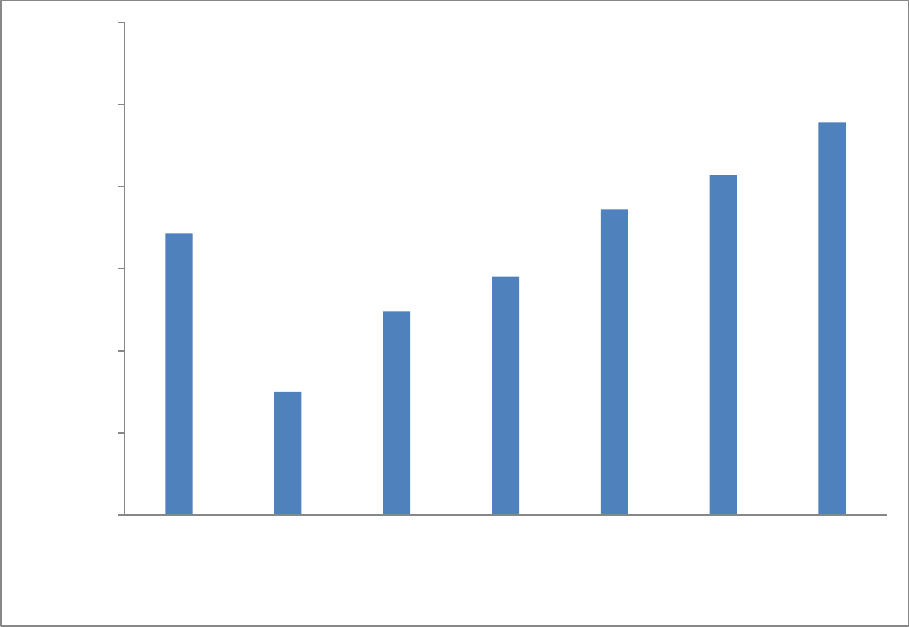

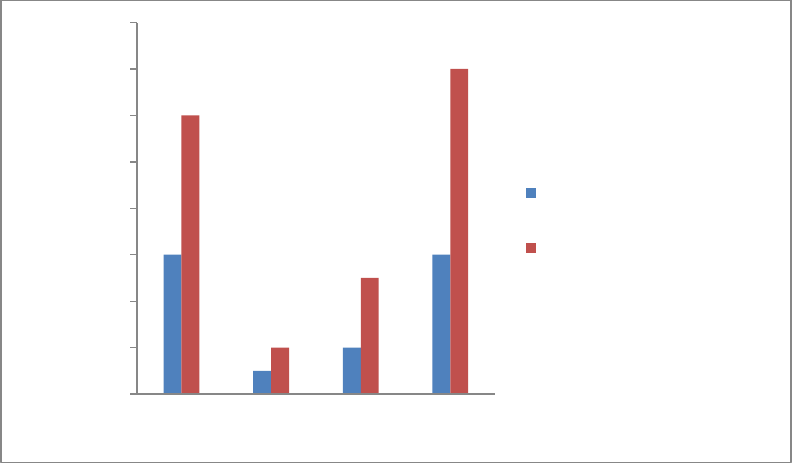

Figure 1: Pay frequency reported at application

Most states with payday lending storefronts set a maximum fee per $100 borrowed that lenders

may charge, which typically ranges between $10-20 per $100. A few states have higher or no

limits, while others employ a sliding scale, depending on loan size.

19

The median fee we

observed in our sample was $15 per $100. Table 1 provides a summary of mean and median loan

amounts, fees per $100, duration, and APR for the loans in our sample.

19

An example of a state with a sliding scale fee schedule is Michigan, where a fee of $15 is assessed on the first $100

borrowed, then $14 on the second $100, $13 on the third $100, and so on. See Michigan Deferred Presentment

Service Transaction Act § 487.2153.

55%

33%

12%

Biweekly / Semi-monthly

Monthly

Weekly

CONSUMER FINANCIAL PROTECTION BUREAU

17

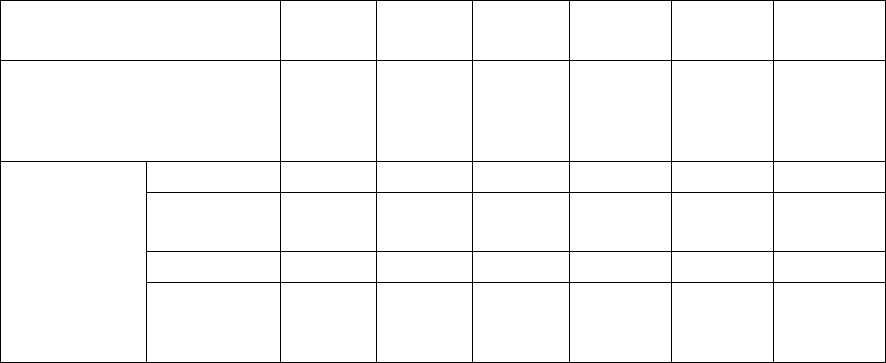

Table 1: Summary of loan characteristics

Mean

Median

Loan amount

$392

$350

Fee per $100

$14.40

$15

Duration

18.3 days

14 days

APR

339%

322%

Note: Summary statistics should not be interpreted as reflective of the characteristics of an “average” loan. Individual

data findings for average loan amount, fee, duration, and APR are calculated separately and do not relate to one

another. For instance, the loans in our sample have a median cost of $15 per $100. This would equate to a fee of

$52.50 on the median $350 loan. In this example, the borrower would owe $402.50 to be repaid on her due date. The

APR on that particular loan with a median duration of 14 days would be 391%.

3.1.2 Borrower Income

Here, we examine the income that consumers document as part of the application process in

order to qualify for a loan, and the source of that income.

20

Storefront payday borrowers in our

sample have income that is largely concentrated in income categories ranging from $10,000-

$40,000 on an annualized basis.

21

20

Consumers typically provide a recent pay stub, recent deposit account statement, or other information to document

income as part of the application process.

21

Our dataset includes information on the amount and frequency of income that can be used to calculate an

annualized figure for each borrower in our sample. Because the source of this income information could be a paystub

or deposit account statement, it may be net income after taxes and other items have been deducted. The income data

reported in this section is only available for a sub-set of lenders in our sample.

CONSUMER FINANCIAL PROTECTION BUREAU

18

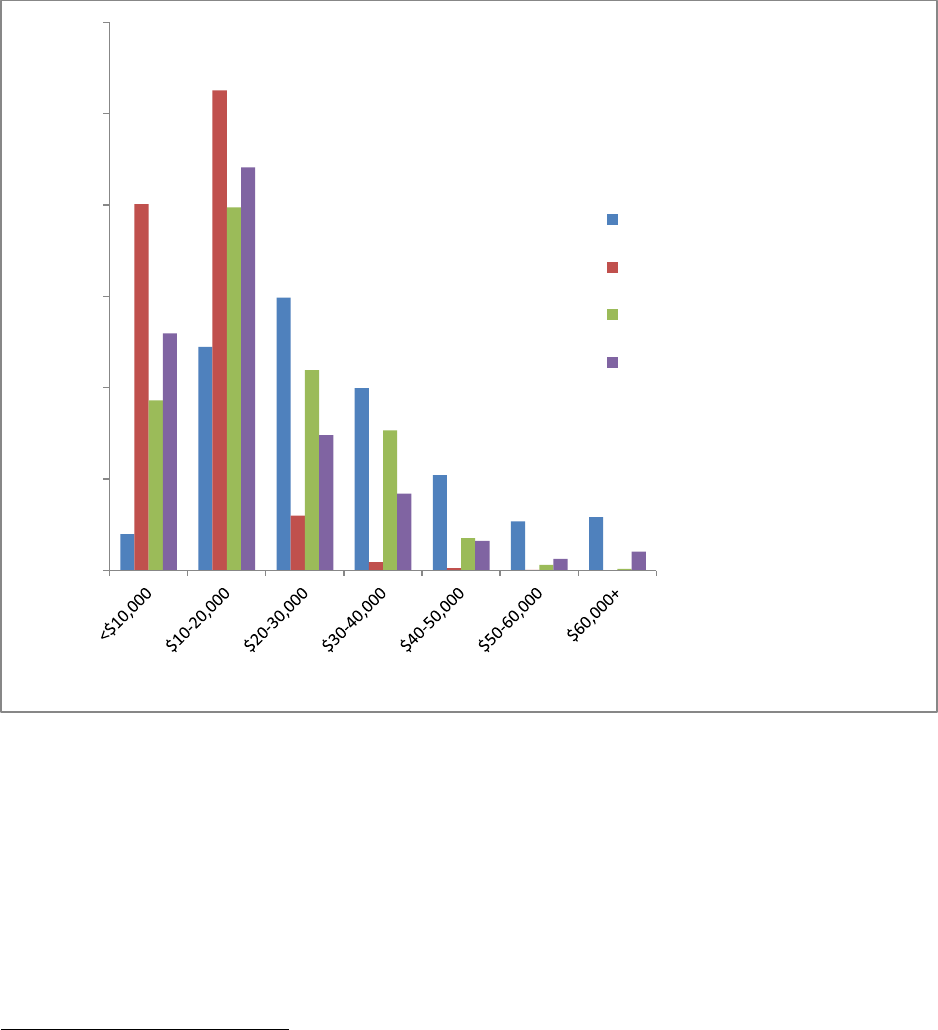

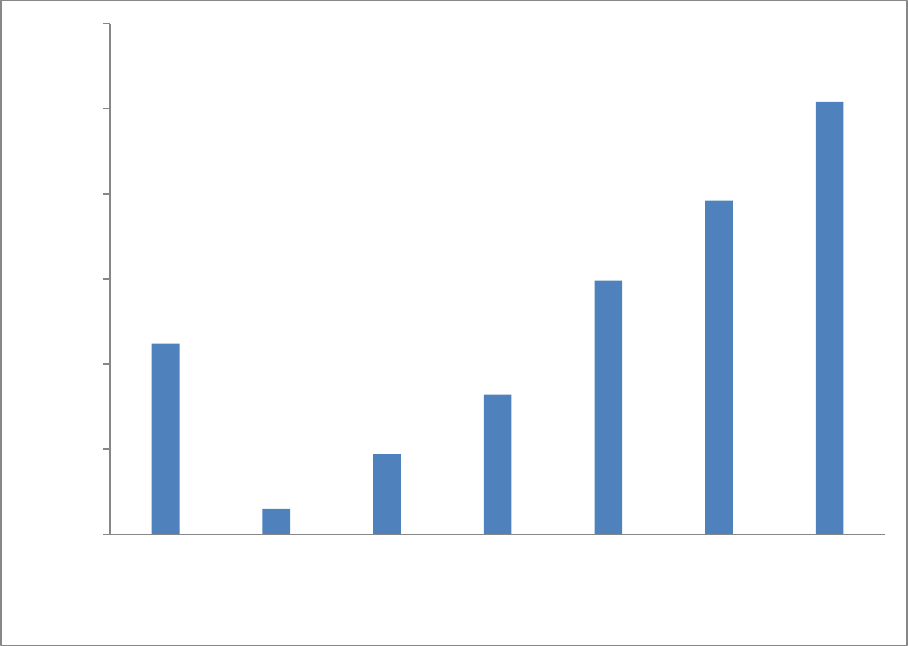

Figure 2: Distribution of income reported at application

Note: Annualized income based on pay period amount and pay frequency reported at the time of payday application.

The median income is $22,476, although a quarter of borrowers have income of $33,876 or

more.

Table 2: Borrower income reported at application

Mean

$26,167

25

th

percentile

$14,172

Median

$22,476

75

th

percentile

$33,876

It is important to note that income used in this analysis may not reflect total household income.

Other income may be present in the household if the borrower receives income from more than

one source or another person in the household also has an income source.

We also observed the source of this income. Three-quarters of consumers in our sample were

employed either part- or full-time. A significant share of consumers—nearly 1 in 4—reported

either some form of public assistance or other benefits (18%) or retirement funds (4%) as an

income source.

12%

31%

25%

16%

8%

4%

4%

0%

5%

10%

15%

20%

25%

30%

35%

<$10,000 $10-20,000 $20-30,000 $30-40,000 $40-50,000 $50-60,000 $60,000+

Share of borrowers

Borrower reported income, annualized

CONSUMER FINANCIAL PROTECTION BUREAU

19

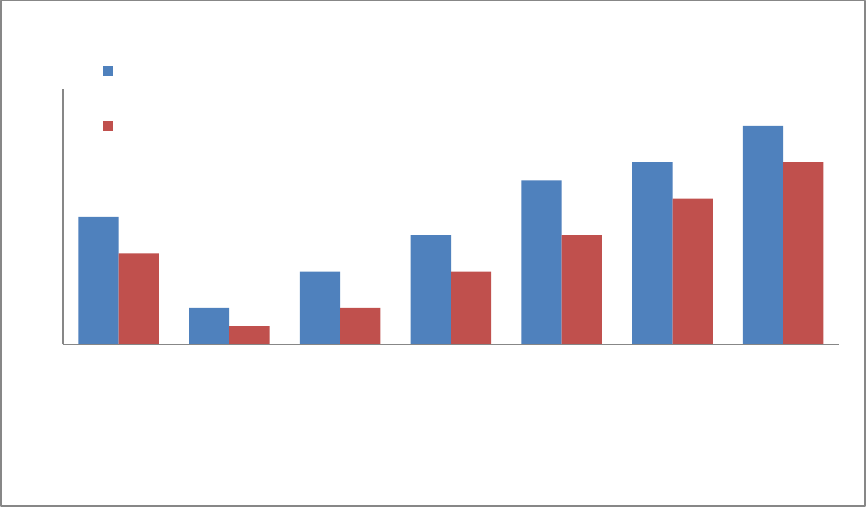

Figure 3: Source of income reported at application

Reported government assistance or benefit income received by the consumers in our sample

consists largely of Social Security payments (including Supplemental Security Income and Social

Security Disability Insurance),

22

unemployment, and other federal or state public assistance.

23

These payments are usually of a fixed amount, typically occurring on a monthly basis. As shown

in Figure 4 below, borrowers reporting public assistance or benefits as their income source are

more highly concentrated towards the lower end of the income range for the payday borrowers

in our sample.

22

Supplemental Security Income (SSI) payments are to qualified adults and children with disabilities and people who

are 65 years or older with limited income and resources. Social Security Disability Insurance payments are to persons

with disabilities who have paid enough employment taxes to the Social Security Trust Fund.

23

It is possible that some benefit payments from private sources such as employer-provided disability benefits may

also be captured in this category.

75%

18%

4%

3%

Employment

Public Assistance/Benefits

Retirement

Other

CONSUMER FINANCIAL PROTECTION BUREAU

20

Figure 4: Distribution of income reported at application by source

Note: Percentages represent share of borrowers in each income range within each income source category.

3.1.3 Intensity of Use

One of the primary goals of our analysis is to understand payday loan usage patterns. This

section provides preliminary findings on the extent to which consumers in the study sample

used this product during the 12-month study period and on the patterns of that use.

24

In order

24

Loan usage patterns are based on our sample borrowers who take out a loan in the initial month of a lender’s

dataset. Usage is then tracked for a total of 12 months. These results thus reflect the subsequent experiences of a

representative set of consumers whose loan usage would include the first month of the study sample. Therefore, our

analysis does not reflect a given lender’s portfolio over the course of a calendar year, since the lender would also have

0%

10%

20%

30%

40%

50%

60%

Share of borrowers

Borrower reported income, annualized

Employment

Public Assistance/Benefits

Retirement

Other

CONSUMER FINANCIAL PROTECTION BUREAU

21

to report usage levels consistently across borrowers, we consider loans and any rollovers of

existing loans as separate transactions. For example, a consumer who takes out one loan and

rolls it over once is considered to have two transactions (or loans) for purposes of this white

paper. Similarly, a consumer who takes a loan, pays it back, and opens a new loan would also be

considered to have two transactions.

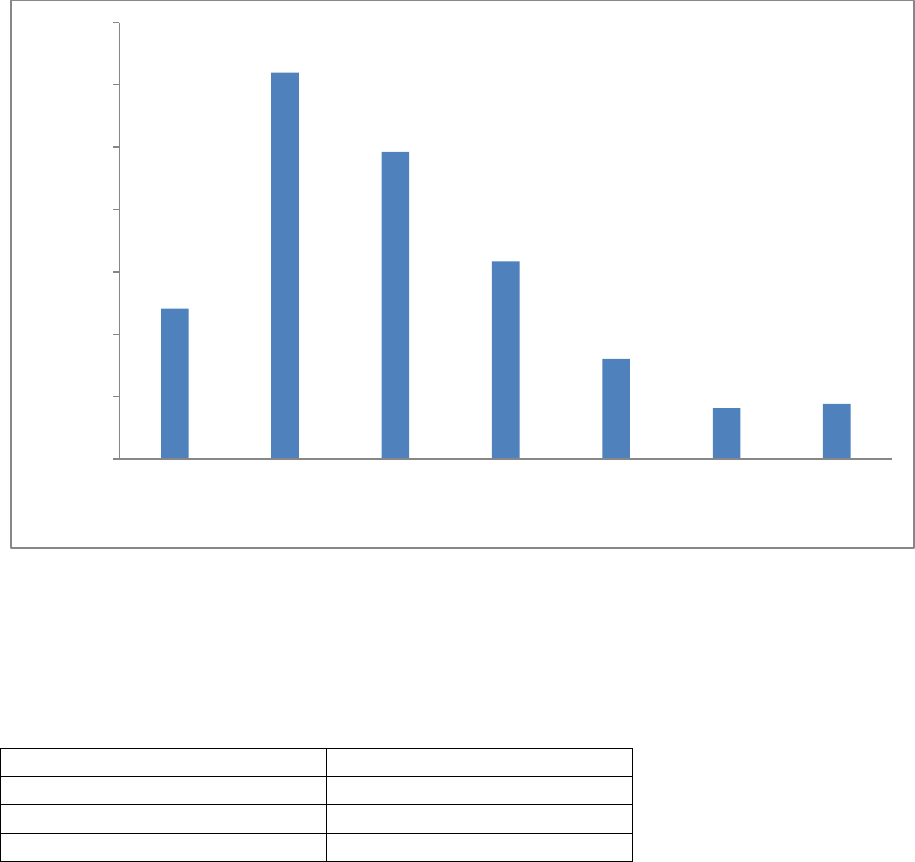

Figure 5 below shows the distribution of loan use across consumers in our sample. Usage is

concentrated among those consumers in our sample with 7 or more transactions in the 12-

month study period. Nearly half (48%) of borrowers had more than 10 transactions over this

same time period; of these, 29% (14% of all borrowers) had over 20 transactions. In contrast,

13% of borrowers had 1-2 transactions and another 20% had 3-6 transactions over the 12-month

period. These consumers had a relatively low intensity of use.

25

loan volumes and revenues derived from borrowers who do not take loans in the first month. Two factors may cause

the usage statistics in our sample to show somewhat more intense usage than analyses based on all loans made in a

calendar year. First, high-intensity borrowers are more likely to be sampled based on usage in a given month than

low-intensity borrowers. Second, we exclude borrowers whose initial loan in the 12-month study period occurs after

the initial month in the lender’s sample, since their usage cannot be tracked over a full 12 months.

25

Usage rates include borrowers who default and may become ineligible for future payday loans. For instance, some

share of borrowers who take out a single payday loan may have this low amount of usage because they never paid

their loan back and, as a result, were not provided additional credit by that lender in our 12-month study period.

CONSUMER FINANCIAL PROTECTION BUREAU

22

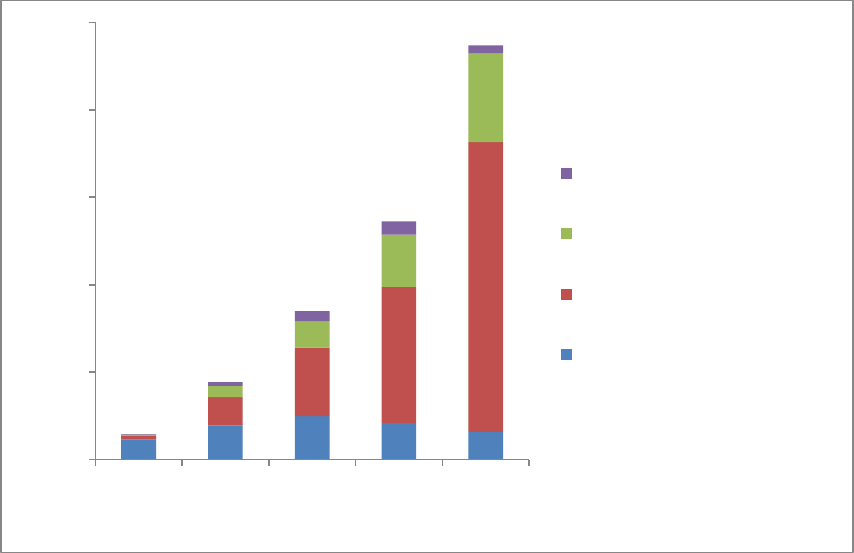

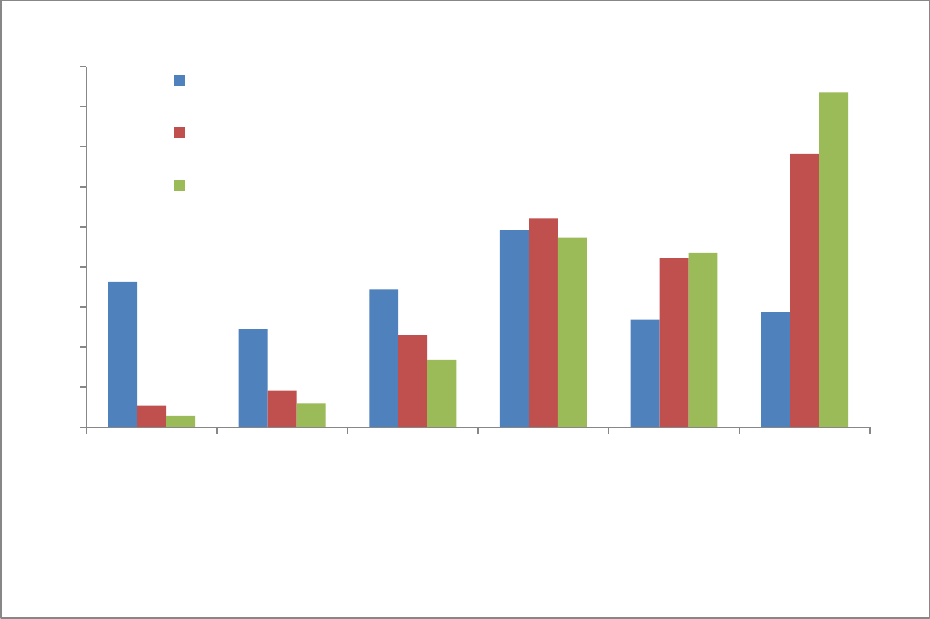

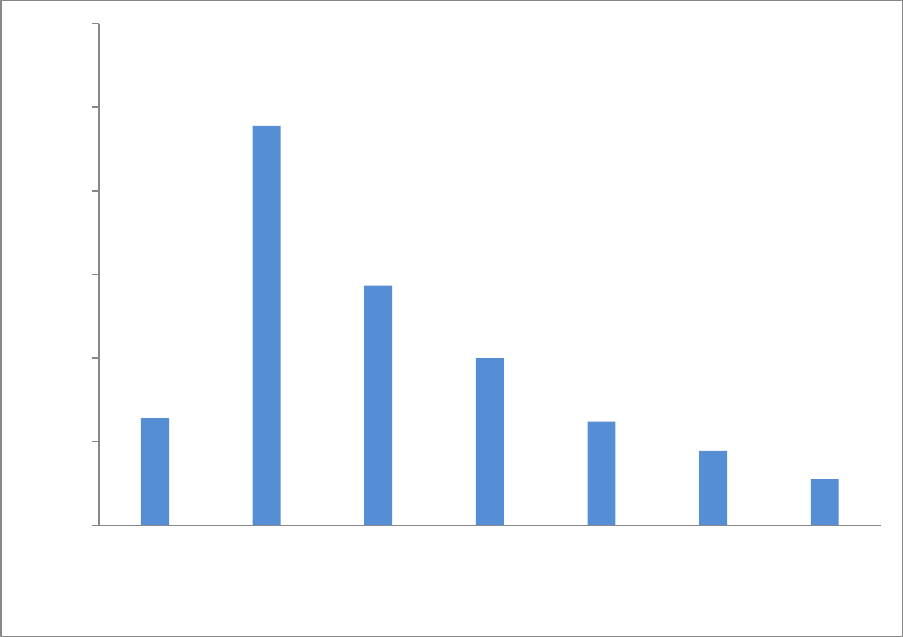

Figure 5: Distribution of loan use, volume, and fees

The figure also shows the distribution of loan volume and loan fees across consumer usage

groups. Three-quarters of all loan fees generated by consumers in our sample come from those

with more than 10 transactions during this period. In contrast, loan fees generated by

consumers who borrowed six or fewer times over 12 months make up 11% of the total for this

sample of borrowers.

26

Overall, the median consumer in our sample conducted 10 transactions over the 12-month

period and paid a total of $458 in fees, which do not include the loan principal.

27

One quarter of

borrowers paid $781 or more in fees.

26

As described in n. 24 above, these data differ from what would be observed in a lender’s overall portfolio over a

one-year period.

27

An important policy question here is the benefit the consumer receives, in the form of credit extended, in return for

the fees paid. As shown in Figure 6 in a subsequent section, many new loans are taken out within the same day a

previous loan is repaid or shortly thereafter; therefore, it is arguable that these transactions should not be treated as

new extensions of credit for this purpose.

13%

20%

19%

34%

14%

2%

9%

15%

43%

32%

2%

8%

15%

43%

33%

0%

5%

10%

15%

20%

25%

30%

35%

40%

45%

1 - 2 3 - 6 7 - 10 11 - 19 20+

Number of transactions per borrower over 12 months

Share of Borrowers

Share of Fees

Share of Dollars Advanced

CONSUMER FINANCIAL PROTECTION BUREAU

23

Table 3: Number of transactions and total fees paid over 12 months

#

transactions

Total fees

paid

Mean

10.7

$574

25

th

percentile

5

$199

Median

10

$458

75

th

percentile

14

$781

Since payday loans can be made for varying durations based on consumers’ pay cycles, the

frequency at which consumers received income may impact the number of transactions they

conducted. Consumers paid on a more frequent basis may have the ability to take more loans

over a certain period of time than others paid fewer times per year. The number of transactions

conducted by a consumer can also be impacted by state law, which may cap the number of loans

made in a given year or mandate cooling-off periods.

28

Because of this, we also examined the

number of days in the 12-month study period that consumers were indebted. This provides a

uniform measure for consumers with different use patterns, pay frequencies, and loan

durations.

We find that consumers in our sample had a median level of 199 days indebted, or roughly 55%

of the year. A quarter of consumers were indebted for 92 days or less over the 12-month study

period, while another quarter was indebted for more than 300 days. The length of time a

consumer is indebted is driven by three factors: (1) the number of transactions they conduct; (2)

the number of days until each loan is due; and—to a much lesser extent—(3) whether that

consumer has delinquent loans that remain outstanding beyond the contractual due date.

Table 4: Number of days and share of the year indebted

Mean

196

54%

25

th

percentile

92

25%

Median

199

55%

75

th

percentile

302

83%

28

Some states have laws that would restrict maximum usage, such as an eight loan per year limit in Washington, a

minimum loan duration of two pay cycles in Virginia, and mandated cooling-off periods after a certain amount of

usage in Oklahoma and Virginia.

CONSUMER FINANCIAL PROTECTION BUREAU

24

3.1.4 Sustained Use

Of particular importance to our analysis is the timing of the use of payday loans and whether we

observe patterns of sustained, rather than sporadic, use. A pattern of sustained use may

indicate that a borrower is using payday loans to deal with expenses that regularly outstrip their

income. It also may indicate that the consumer is unable to pay back a loan and meet her other

expenses that occur within the same pay period.

To shed light on this issue, we evaluate the distribution of borrowing patterns across consumer

usage groups. This allows us to observe the share of transactions that are consistent with a

pattern of sustained use, defined as transactions which occurred either the same day a previous

loan was closed or soon after. Figure 6 below classifies consumers into five groups based on the

number of transactions they conducted over the 12 month period. For each group, we can

observe what share of transactions conducted by these consumers are the initial loans or loans

after a break in indebtedness of at least 15 days. Likewise, we can observe the share of

transactions that occurred shortly after a previous loan was closed—either the same day, within

1-7 days, or within 8-14 days.

CONSUMER FINANCIAL PROTECTION BUREAU

25

Figure 6: Share of transactions initiated within 14 days of a previous transaction

Note: The total height of each bar represents the mean number of transactions a borrower in each usage category

conducted over 12 months. The height of each sub-category represents the mean number of transactions per

consumer in the 12-month period that were conducted on the same day, within 1-7 days, or within 8-14 days of the

close of a previous loan, as well as a sub-category that represents initial loans and new loans opened 15 days or longer

after a previous loan was repaid.

The vast majority of loans made to consumers with 1-2 transactions in the 12 month period were

either initial loans or loans taken after a 15 day or longer break. By definition, all borrowers with

a single transaction would meet these criteria since they only took an initial loan.

For those consumers taking out more than two loans during the 12 month period, an increasing

share were attributable to transactions that are taken out on a sustained basis; that is, within 14

days of the prior loan. Transactions taken by consumers with 3-6 loans in the 12 month period

were about evenly split between continuous loans and loans that are either the initial in our

study period or taken out after a 15 day or longer break after closing the previous loan.

The majority of transactions conducted by consumers with at least 7 transactions a year were

taken on a nearly continuous basis. Most frequently, these new transactions were opened within

a day of a previous loan closing. We discuss the significance of these findings in the final section

of this paper.

0

5

10

15

20

25

1-2 3-6 7-10 11-19 20+

Mean number of transactions

Number of transactions per borrower over 12 months

Loans taken within 8-14 days of

previous loan

Loans taken within 1-7 days of

previous loan

Loans taken on same day

previous loan closed

Initial loans and new loans after

15+ day break

CONSUMER FINANCIAL PROTECTION BUREAU

26

3.2 Deposit Advances

For our study of deposit advances, we gathered data from a number of depository institutions.

Some of these data are used here to describe outcomes for consumers during a 12 month study

period. Since deposit advance eligibility typically depends on recent electronic deposit history,

NSF and overdraft activity, and previous deposit advance use, a consumer’s eligibility can

fluctuate over time. Consumers included in this analysis had accounts that were either: (1)

eligible to take an advance during the first month of the study period or (2) eligible during

subsequent months if they had been eligible sometime during the quarter prior to the beginning

of the study period.

29

Consumers with accounts opened after the beginning of the study period

and accounts that became newly eligible later in the study period were excluded. Based on these

criteria, an equal number of accounts were randomly selected for each institution; hence the

outcomes reported here can be thought of as averages across institutions, rather than outcomes

for the underlying population of accounts that satisfied these criteria.

30

This sampling

methodology was used so that patterns measured below cannot be attributed to any specific

institution.

About half of the institutions’ consumer deposit accounts were eligible for deposit advances. Our

sample contains more than 100,000 eligible accounts, with roughly 15% of accounts having at

least one deposit advance during the study period. We compare deposit advance users and

consumers who are eligible for—but did not take—any advances, as well as deposit advance

users with varying levels of use.

29

The data obtained by the CFPB covers a period longer than the study period and thereby enables us to observe

eligibility prior to the start of the study period.

30

The analysis of the deposit advance product presented in this paper draws on information collected through the

supervisory process, aggregated to preserve the confidentiality of individual institutions.

CONSUMER FINANCIAL PROTECTION BUREAU

27

3.2.1 Loan Characteristics

The median size of an individual advance was $180. However, consumers can take out multiple

advances in small increments up to their specified credit limit prior to repaying outstanding

advances and associated fees out of the next electronic deposit. Thus, merely observing the size

of an individual advance without considering the number of advances taken before repayment

may not fully capture the extent of borrowing.

To provide a more meaningful representation of loan characteristics, we also analyzed each

“advance balance episode,” defined as the number of consecutive days during which a consumer

has an outstanding deposit advance balance. The median average daily balance of all advance

balance episodes was $343, which is larger than the $180 median advance. This reflects the

tendency of some consumers to take multiple advances prior to repayment.

To measure the duration and APRs associated with incremental deposit advance use or

repayments from multiple deposits, we again used the concept of advance balance episodes.

Each advance balance episode has a well-defined duration and average daily outstanding

balance that can be used to measure an APR, given total advance fees that are a fixed percent of

advances extended during the period.

31

We took this approach to measuring APRs in dealing with consumers who take incremental

advances prior to the receipt of the next electronic deposit and with advances that are repaid out

of successive electronic deposits credited to the account at different dates. When a consumer

takes multiple advances prior to a given incoming electronic deposit, each is subject to the same

fee measured as a percent of the advance amount. However, each advance will have a different

duration (measured as the number of days until repayment) and, therefore, a different APR.

Similarly, when an incoming electronic deposit is insufficient to fully repay an outstanding

deposit advance balance, segments of the advance repaid at a different dates will have varying

durations (and, again, different APRs).

31

This fee-based APR calculation is solely intended to facilitate comparisons between payday loans and deposit

advances for the purposes of this white paper and should not be relied upon for any other purpose. When disclosing

APR, lenders must comply with currently applicable legal requirements.

CONSUMER FINANCIAL PROTECTION BUREAU

28

The median duration of advance balance episodes in our sample was 12 days. Using this

duration, we can calculate an APR for different fees that may be charged for an advance. For

example, a typical fee is $10 per $100 borrowed.

32

This fee would imply an APR of 304% given a

12-day duration. A hypothetical lower fee of $5 per $100 advanced would yield an APR of 152%,

while a hypothetical higher fee of $15 per $100 advanced and would yield an APR of 456% with

the same 12-day term. Thus, the APR will vary significantly depending on the duration of a

particular advance balance episode and the fee charged by an individual institution.

3.2.2 Consumer Account Characteristics

While we did not directly observe the total income of consumers who use deposit advances in

our sample, we did observe deposits to their accounts. We can also measure other account

characteristics in our data, such as average daily balances, and how consumers transact from

their accounts. An important part of our analysis was to compare how these types of account

activity differ for consumers who use advances and for consumers who are eligible for deposit

advances but do not use the product (“eligible non-users”). In general, these findings are

measured on an average per-month basis for the months that the deposit account was open

during the study period.

Consumers in our study sample who took deposit advances had a median of just under $3,000

in average monthly deposits. While monthly deposits are not necessarily indicative of, or

directly comparable to, monthly income (deposits can reflect money transferred into an account

from other sources), average monthly deposits do reflect available resources. As compared to

eligible non-users, consumers taking deposit advances tended to have slightly lower average

monthly deposits.

32

This fee is expressed in slightly different ways depending on the institution, such as $2 per $20 borrowed, or $1 per

$10 advanced, but is the equivalent to a $10 fee for every $100 borrowed.

CONSUMER FINANCIAL PROTECTION BUREAU

29

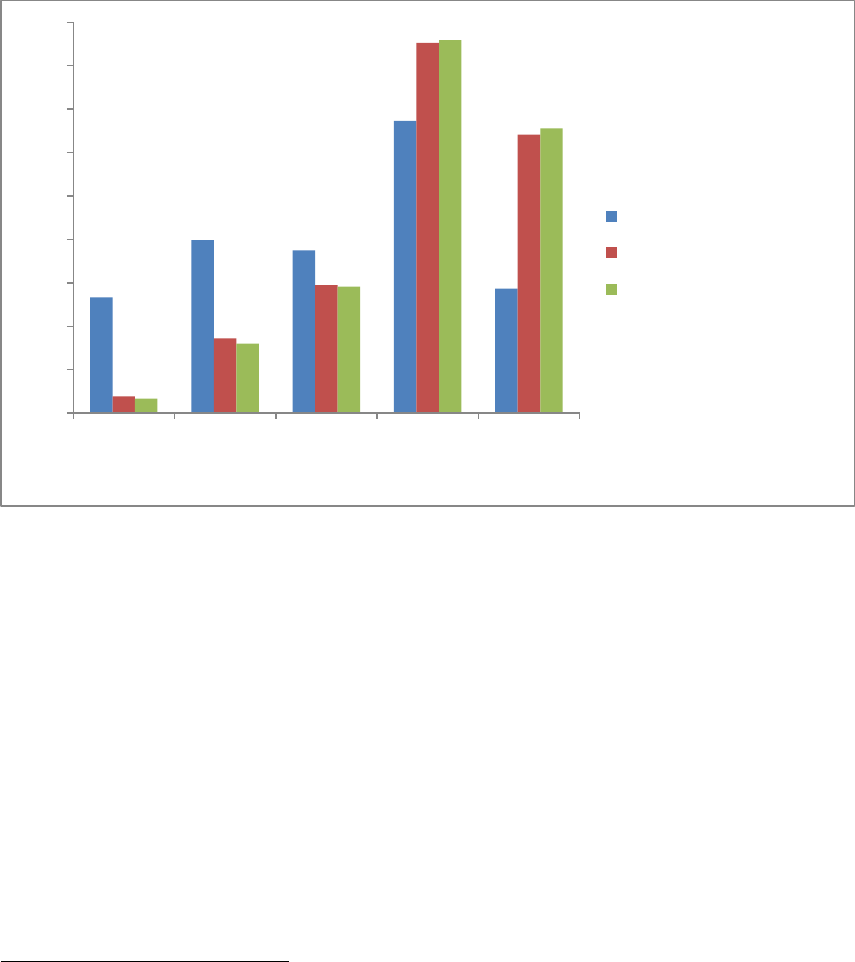

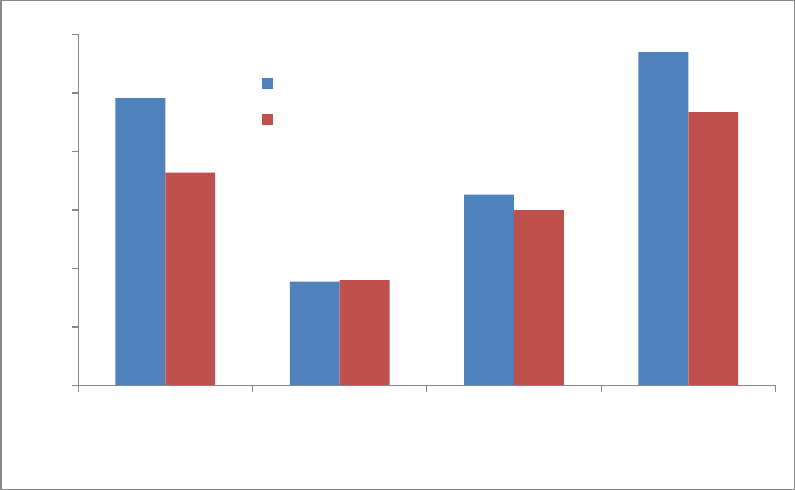

Figure 7: Average monthly deposits

Note: Not all accounts in the sample were open for the entire 12-month study period. Average deposits were

measured for months during which the account was open.

Consistent with lower deposits to the account, deposit advance users also tended to have a lower

volume of payments and other account withdrawals than eligible non-users.

$4,915

$1,773

$3,265

$5,702

$3,637

$1,797

$2,996

$4,671

$0

$1,000

$2,000

$3,000

$4,000

$5,000

$6,000

Mean 25th percentile Median 75th percentile

Eligible non-users

Deposit advance users

CONSUMER FINANCIAL PROTECTION BUREAU

30

Figure 8: Average monthly consumer-initiated debits

Note: Not all accounts in the sample were open for the entire 12-month study period. The average dollar volume of

consumer-initiated debits was measured for months during which the account was open

.

However, deposit advance users tended to conduct a larger number of account transactions than

eligible non-users, particularly debit card transactions.

$4,723

$1,624

$3,021

$5,361

$3,450

$1,697

$2,831

$4,433

$0

$1,000

$2,000

$3,000

$4,000

$5,000

$6,000

Mean 25th percentile Median 75th percentile

Eligible non-users

Deposit advance users

CONSUMER FINANCIAL PROTECTION BUREAU

31

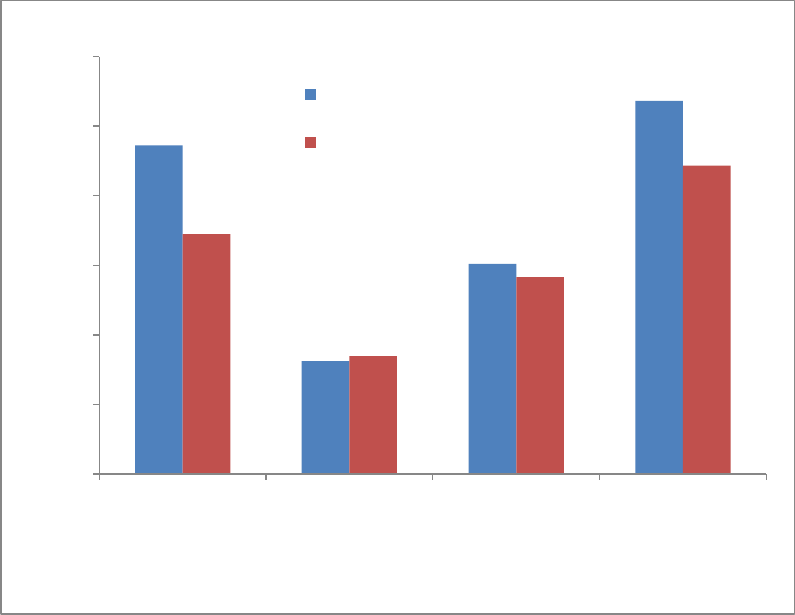

Figure 9: Average monthly number of consumer-initiated debits

Note: Not all accounts in the sample were open for the entire 12-month study period. The average number of

consumer-initiated debits per month is measured for months during which the account was open.

Deposit advance users tended to have much lower average daily balances than eligible non-

users. This suggests that deposit advance users have less of a buffer to deal with financial short-

falls (balances reported here include deposit advances that have been credited to a consumer’s

deposit account).

25

10

44

30

0

5

10

15

20

25

30

35

40

45

50

All customer initiated

debit transactions

Debit card

transactions

Median transactions per month

Eligible non-users

Deposit advance users

CONSUMER FINANCIAL PROTECTION BUREAU

32

Figure 10: Average daily account balance

Note: Not all accounts in the sample were open for the entire 12-month study period. The average daily account

balance for each account is measured for days during which the account was open.

3.2.3 Intensity of Use

To better understand how consumers in our sample use deposit advances, we first present

information on the number of advances taken and total dollar amount advanced during the

study period, as well as the number of advance balance episodes deposit advance users have

over the 12-month study period.

As previously explained, because consumers can take multiple advances up to their specified

credit limit with repayment out of the next electronic deposit, measuring the number of

advances is not necessarily an accurate means of measuring the intensity of use. For example, a

consumer who takes out two advances each of $50 on successive days is not necessarily using

the product more intensely than a consumer who takes out a single advance of $100. To assess

intensity of use in light of the incremental nature of some consumers’ use of the deposit advance

product, we classify accounts in terms of the total dollar volume of advances taken during the

12-month study period rather than the number of advances that were extended.

As with payday borrowers, we found that a significant share of deposit advance borrowers took a

sizable volume of advances during the 12-month study period. On the one hand, 30% of all

$5,460

$727

$1,702

$4,447

$636

$178

$396

$759

$-

$1,000

$2,000

$3,000

$4,000

$5,000

$6,000

Mean 25th

percentile

Median 75th

percentile

Eligible Non-Users

Deposit Advance Users

CONSUMER FINANCIAL PROTECTION BUREAU

33

borrowers in our sample had total advances of no more than $1,500; which we refer to as light

to moderate annual use of the deposit advance product. On the other hand, more than half of

deposit advance users in our sample took advances totaling more than $3,000. Further, more

than a quarter (27%) of deposit advance borrowers took advances totaling more than $6,000

over 12 months, and more than half of this group (14% of the total population of deposit advance

borrowers) took advances in excess of $9,000.

The two highest usage groups accounted for 64% of the total dollar volume of advances and

more than half (55%) of the total number of advances extended. In contrast, the borrowers who

used $1,500 or less in advances during the same time period accounted for less than 10% of the

total dollar amount and number of advances.

Figure 11: Distribution of loan use and volume

Note: Each account is classified by the dollar volume of deposit advances taken during the 12-month study period.

Not all accounts in the sample were open for the entire study period.

Table 5 illustrates that higher deposit advance usage during the 12-month period tends to reflect

borrowers’ frequent, as well as larger, advances.

18%

12%

17%

25%

13%

14%

3%

5%

12%

26%

21%

34%

1%

3%

8%

24%

22%

42%

0%

5%

10%

15%

20%

25%

30%

35%

40%

45%

< $750 $750-$1,500 $1,500-$3,000 $3,000-$6,000 $6,000-$9,000 > $9,000

Total advances during the 12-month study period

Share of deposit advance users

Share of total advances

Share of total dollars advanced

CONSUMER FINANCIAL PROTECTION BUREAU

34

Table 5: Median amount per advance and median number of advances

Amount use groups

All

account

with

advances

<$750

$750-

$1,500

$1,500-

$3,000

$3,000-

$6,000

$6,000-

$9,000

>$9,000

Median

amount

per

advance

$180

$100

$100

$100

$160

$200

$200

Median

number of

advances

14

2

6

11

17

26

38

Note: Each account was classified by the dollar volume of deposit advances taken during the 12-month study period.

Not all accounts in the sample were open for the entire study period.

As discussed in a previous section, we also measure use in terms of each advance balance

episode—defined as the period of time in which a consumer has an advance outstanding. We

found that the median number of episodes for all advance users in our study sample is eight per

year. This varied from a median of just two episodes for the lowest use group to a median of 19

episodes for the highest use group.

CONSUMER FINANCIAL PROTECTION BUREAU

35

Figure 12: Median number of advance balance episodes over 12-month period

Note: An advance balance episode is defined as a period during which the account holder had an outstanding deposit

advance balance. An advance balance episode may involve more than one advance or more than one repayment. Not

all accounts in the sample were open for the entire 12-month study period.

Higher usage during the 12-month study period also reflected larger outstanding balances

during advance balance episodes. For the lowest usage group, the median average daily advance

balance was $150, while for consumers in the two highest usage groups, average daily balances

of advance balance episodes tended to exceed $400.

8

2

4

7

10

15

19

0

2

4

6

8

10

12

14

16

18

20

All accounts

with advances

< $750 $750-$1,500 $1,500-$3,000 $3,000-$6,000 $6,000-$9,000 > $9,000

Median number of episodes

Total advances during the 12-month study period

CONSUMER FINANCIAL PROTECTION BUREAU

36

Figure 13: Average outstanding advance balance

Note: An average daily balance is computed for each period during which an account holder has an outstanding

deposit advance balance. Not all accounts in the sample were open for the entire 12-month study period.

We also measured the total number of days that each consumer in our sample was indebted by

using the duration of each advance balance episode. Consumers in our sample were indebted for

a median of 112 days (31% of the year), with the number of days generally increasing with the

total volume of advances taken. Consumers taking more than $3,000 in advances during the 12-

month study period tended to be indebted for more than 40 percent of the year.

$343

$150

$248

$290

$372

$414

$478

$-

$100

$200

$300

$400

$500

$600

All accounts

with advances

< $750 $750-$1,500 $1,500-$3,000 $3,000-$6,000 $6,000-$9,000 > $9,000

Median for the usage group

Total advances during the 12-month study period

CONSUMER FINANCIAL PROTECTION BUREAU

37

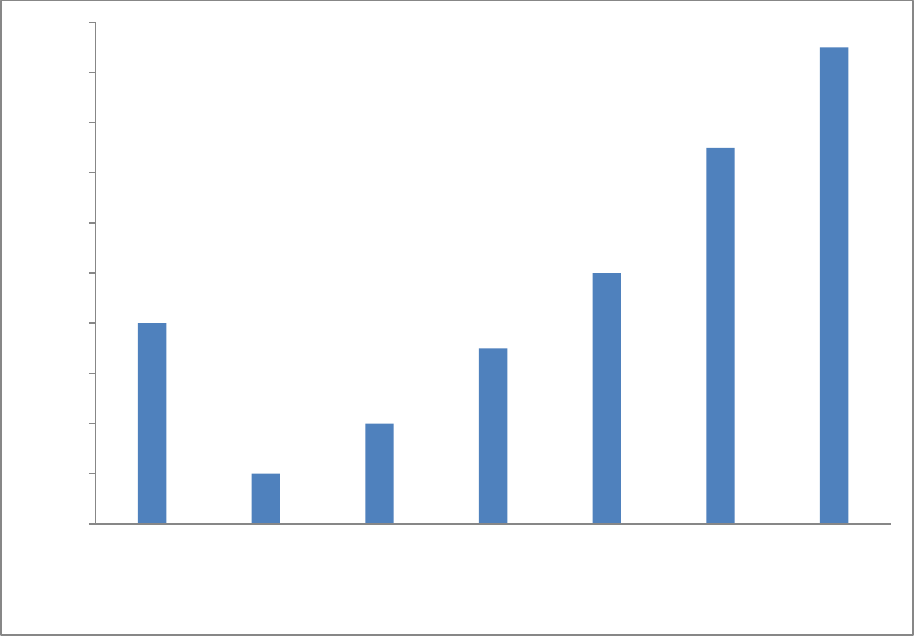

Figure 14: Median total days with outstanding advance balance

Note: Median number of days with outstanding advance balances during the 12 month-study period; not all accounts

in the sample were open for the entire 12-month study period.

It is important to note that because we are analyzing consumers based on their eligibility for the

deposit advance product, reported usage patterns are not directly comparable to those analyzed

for payday borrowers that were included in the sample only if they had taken a loan in the first

month of the study period. The deposit advance usage patterns measure usage by consumers

who were eligible to use the product at the beginning of the sample period, but some consumers

who used the product may not have done so until later in the year. Neither the payday loan nor

the deposit advance findings capture any continuing use after the 12-month period analyzed.

Usage patterns for both products also reflect use that ends because a consumer does not repay

the loan and hence, the account is charged off.

112

15

47

82

149

196

254

0

50

100

150

200

250

300

All accounts

with advances

< $750 $750-$1,500 $1,500-$3,000 $3,000-$6,000 $6,000-$9,000 > $9,000

Median number of days

Total advances during the 12-month study period

CONSUMER FINANCIAL PROTECTION BUREAU

38

3.2.4 Sustained Use

In addition to examining the advance activity of consumers during the 12-month period, we also

analyze whether that indebtedness (measured in terms of advance balance episodes) occurred

on a sustained, nearly uninterrupted basis.

We examined the total number of months in which each consumer in our sample took deposit

advances and the longest number of consecutive months that advances were used. The median

number of months in which a consumer had outstanding advance balances was seven; however

consumers with $1,500 or less in annual advances typically had outstanding advances in four or

fewer months while consumers with over $3,000 in annual advances typically had outstanding

advances in 9 or more months, and at least six consecutive months during the 12-month period

we examined here. It is important to note that that not all consumers were eligible to take

deposit advances in every month of the study period so breaks in usage may be attributable to

other factors.

33

33

For example, some accounts closed before the end of the study period. And, while most accounts were open for the

entire period, many consumers were not eligible to take deposit advances for the entire year. In addition to other

criteria that affect eligibility, variations also reflect policies requiring cooling-off periods after a specific period and/or

intensity of use. Cooling-off policies are reflected in a reduction in amount of time that heavy advance users are

eligible during the 12-month study period, compared to otherwise similar consumers with less usage. As intended,

cooling-off policies set an upper bound on the number of months consumers can take advances.

CONSUMER FINANCIAL PROTECTION BUREAU

39

Figure 15: Months with deposit advance activity

Note: Not all accounts in the sample were open for the entire 12-month study period.

Likewise, to determine whether advances are used with little break in between, we can observe

the average number of days between each consumer’s advance balance episodes using the dates

that each deposit advance episode begins and ends.

Among consumers in our sample with more than one advance balance episode, the median

number of days between advances was 13. Consumers who had the least use also had longer

breaks between usage; for example, those consumers in the lowest usage group who had more

than one advance episode had a median of 48 days between these uses of deposit advance. This

break declined markedly among consumers with higher levels of use. Borrowers in the highest

three usage groups tended to have 12 or fewer days between advance balance episodes.

7

2

4

6

9

10

12

5

1

2

4

6

8

10

0

2

4

6

8

10

12

14

All accounts

with advances

<$750 $750-$1,500 $1,500-$3,000 $3,000-$6,000 $6,000-$9,000 >$9,000

Total advances during 12-month study period

Months with advances

Maximum consecutive months of deposit advance

use

CONSUMER FINANCIAL PROTECTION BUREAU

40

Figure 16: Average number of days between advance balance episodes

Note: The average number of days between a consumer's advances is calculated for each account with at least two

advances during the 12-month study period; not all accounts in the sample were open for the entire 12-month study

period.

3.2.5 Deposit Advance Use and Overdraft/NSF Activity

In addition to offering deposit advance, the depository institutions in our analysis may also

provide overdraft coverage. Overdraft fees may be assessed when a depository institution pays

items even though the consumer does not have sufficient funds in her account (or in another

account which the consumer has linked to the deposit account). If, instead of paying the item,

the bank elects to return it as an unpaid NSF item, a fee may also be charged.

Some institutions market deposit advances as a way for consumers to avoid overdraft fees when

they do not have sufficient funds in their accounts to cover transactions. However, deposit

advances are typically not offered as a form of “overdraft protection” that would automatically

cover non-sufficient funds items up to a consumer’s deposit advance limit. A consumer taking a

13

48

29

20

12

9

6

0

10

20

30

40

50

60

All accounts

with advances

< $750 $750-$1,500 $1,500-$3,000 $3,000-$6,000 $6,000-$9,000 > $9,000

Median number of days for usage group

Total advances during the 12 month study period

CONSUMER FINANCIAL PROTECTION BUREAU

41

deposit advance to add funds to her account balance must estimate the amount of funds needed

to cover transactions that have not yet cleared as well as future transactions that will occur

before the next deposit.

We found that deposit advance users in our sample of accounts were much more likely to have

incurred an overdraft or NSF fee during the 12-month study period than eligible non-users.

Notably, we found that while just 14% of eligible non-users incurred an overdraft or NSF fee

during the 12 month study period, 65% of those consumers who used deposit advances had

overdraft or NSF activity. Deposit advance users who incurred an overdraft or NSF fee typically

incurred a greater number of fees than eligible non-users with at least one overdraft or NSF fee.

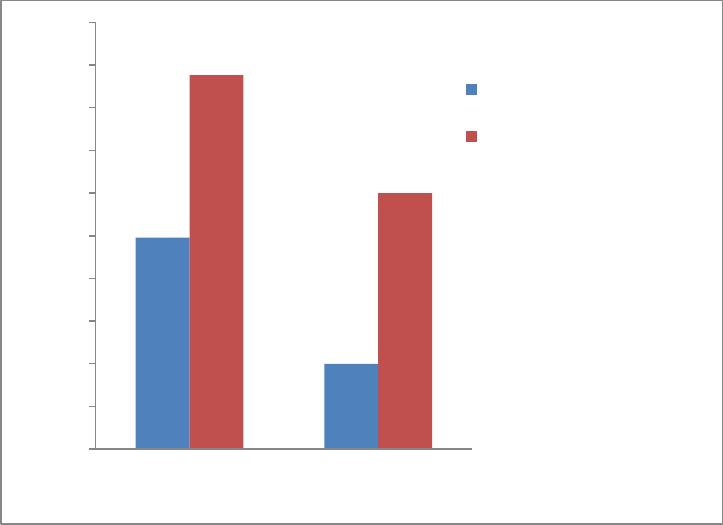

Figure 17: Overdraft and NSF Activity during the 12- month study period

Note: For each account with at least one NSF or overdraft fee, total fees reflect all overdraft and NSF fees incurred by

the account during the study period. However, not all accounts in the sample were open for the entire 12-month

study period.

Consumers with greater deposit advance usage during the study period were more likely to have

had overdraft or NSF transactions. Over four out of five consumers in the two highest usage

groups had at least one overdraft or NSF.

6

1

2

6

12

2

5

14

0

2

4

6

8

10

12

14

16

Mean 25th

percentile

Median 75th

percentile

Total number of OD/NSF fees, for accounts

with at least one fee

14.4% of eligible non-users

incurred overdraft/NSF fees

64.6% of deposit advance users

incurred overdraft/NSF fees

CONSUMER FINANCIAL PROTECTION BUREAU

42

Table 6: Deposit advance usage and overdraft/NSF fees during the 12 month-study

period

<$750

$750-

$1,500

$1,500-

$3,000

$3,000-

$6,000

$6,000-

$9,000

>$9,000

Accounts in deposit

advance usage group with

OD/NSF fees

45%

57%

63%

71%

82%

83%

Number of

OD/NSF

fees for

accounts in

usage group

with any

OD/NSF

fees

Mean

7

9

10

13

17

16

25th

percentile

1

2

2

2

3

3

Median

3

4

4

5

7

7

75th

percentile

7

9

11

14

19

18

Note: For each account with at least one overdraft or NSF fee, total fees reflect all overdraft and NSF fees incurred by

the account during the study period. However, not all accounts in the sample were open for the entire 12-month

study period.

Among consumers with overdraft or NSF activity, the total number of these items tended to

increase with deposit advance usage. Among the four-fifths of consumers in the two highest

usage groups with overdraft or NSF items, the median number of items was seven. However, a

quarter of deposit advance users in our sample in the two highest usage groups with overdraft or

NSF items had 18 or more.

CONSUMER FINANCIAL PROTECTION BUREAU

43

4. Conclusions and Implications

Payday loans and deposit advances are both structured as products designed to meet short-term

credit needs, with the full amount borrowed due at the next payday in the case of payday loans

and due as soon as sufficient qualifying electronic deposits are received (but no later than 35

days) in the case of deposit advances.

It appears these products may work for some consumers for whom an expense needs to be

deferred for a short period of time. The key for the product to work as structured, however, is a

sufficient cash flow which can be used to retire the debt within a short period of time.

The data presented in this study suggest some consumers use payday loans and deposit

advances at relatively low to moderate levels. Thirteen percent of payday borrowers in our

sample took out only 1-2 loans over the 12-month period, and about one-third took out six loans

or less. A similar share of deposit advance users (30%) took no more than a total of $1,500 in

advances over the same period of time.

However, these products may become harmful for consumers when they are used to make up for

chronic cash flow shortages. We find that a sizable share of payday loan and deposit advance

users conduct transactions on a long-term basis, suggesting that they are unable to fully repay

the loan and pay other expenses without taking out a new loan shortly thereafter. Two-thirds of

payday borrowers in our sample had 7 or more loans in a year. Most of the transactions

conducted by consumers with 7 or more loans were taken within 14 days of a previous loan

being paid back—frequently, the same day as a previous loan was repaid. Similarly, over half of

deposit advance users in our sample took out advances totaling over $3,000. This group of

deposit advance users tended to be indebted for over 40% of the year, with a median break

between advance balance episodes of 12 days or less.

We did not analyze whether consumers who use these products more heavily turned to a payday

loan or deposit advance initially because of an unexpected, emergency expense or because their

regular obligations outstripped their income. Nor have we analyzed what other strategies a

consumer might employ, other products she might use in lieu of a payday loan or deposit

advance, or the possible consequences or trade-offs associated with these choices. What appears

clear, however, is that many consumers are unable to repay their loan in full and still meet their

CONSUMER FINANCIAL PROTECTION BUREAU

44

other expenses. Thus, they continually re-borrow and incur significant expense to repeatedly

carry this debt from pay period to pay period. For both products, the high cost of the loan or

advance may itself contribute to the chronic difficulty such consumers face in retiring the debt.

It is unclear whether consumers understand the costs, benefits, and risks of using these

products. On their face, these products may appear simple, with a set fee and quick availability.

However, the fact that deposit advances do not have a repayment date but rather are repaid as

soon as qualified deposits are received adds a layer of complexity to that product which

consumers may not effectively grasp. Moreover, consumers may not appreciate the substantial