www.responsiblelending.org

Payday and Car-Title Lenders Drain

Nearly $8 Billion in Fees Every Year

Diane Standaert, Director of State Policy

Delvin Davis, Senior Researcher

Charla Rios, Researcher

Updated April 2019

The authors wish to thank Carol Hammerstein, Tom Feltner, and Matthew Kravitz for their assistance with

and review of this paper. Delvin Davis, former Senior Research Analyst at the Center for Responsible Lending,

completed his work on this project in August 2018.

Acknowledgments

–––––––––––––––––––––––––––––––––––––––––––––––––––––––––––––––––––––––––

Updated April 2019 1

As shown in Table 1 on page 3, payday loans drain more than $4 billion in fees each year from people in the

34 states that allow triple-digit interest rate payday loans. Car-title loans drain more than $3.8 billion in fees

annually from people in 22 states. Together, these loans drain nearly $8 billion in fees every year.

Data repeatedly show that payday and car-title lenders’

bottom line depends on borrowers being stuck in a cycle

of debt. According to the Consumer Financial Protection

Bureau (CFPB), the average payday borrower is stuck in

10 loans a year, typically one right after the other. This

means that a borrower will pay $458 in fees on a typical

$350 two-week loan. Further, 75% of all payday loan fees are generated from borrowers with more than 10

loans a year. In states with ineffective protections, such as Florida, over 80% of loans go to borrowers with

seven or more loans a year. While comparable data are not available for car-title lenders, the typical car-title

loan is refinanced eight times. As a result, car-title loans extract twice as much in fees as credit extended.

Policy and Market Landscape

–––––––––––––––––––––––––––––––––––––––––––––––––––––––––––––––––––––––––

Introduction

–––––––––––––––––––––––––––––––––––––––––––––––––––––––––––––––––––––––––

The Debt Trap Drives the Fee Drain

–––––––––––––––––––––––––––––––––––––––––––––––––––––––––––––––––––––––––

Payday and car-title loans typically carry annual percentage rates (APR) of at least 300%. These high-cost

loans are marketed as quick solutions to a financial emergency. Research demonstrates, however, that they

frequently lead to debt that is nearly impossible to escape. In addition, these loans are related to a cascade

of other financial consequences, such as increased overdraft fees, delinquency on other bills, involuntary

loss of bank accounts, and even bankruptcy. For car-title loans, the end result is too often the repossession

of the borrower’s car, a critical asset for many people.

Payday loans and car-title loans are marketed as an infusion of cash to financially struggling people. In

reality, these loans often drain hundreds of dollars from a person’s bank account in amounts well above the

original loan amount. Collectively, these loans drain billions of dollars each year in charges on unaffordable

loans to borrowers who have an average annual income of approximately $25,000.1 This fee drain hampers

future asset-building and economic opportunity, with a pronounced effect felt in communities most

impacted by these predatory lending practices.

This brief provides an update on fees drained by payday and car-title lenders, as reported in the Center for

Responsible Lending’s State of Lending report.8 Important regulatory and market changes have occurred

since that time.

At the state level, South Dakota passed a ballot measure in 2016 capping payday and car-title loans at 36%

APR, and Colorado passed a ballot measure in 2018 capping payday loans at 36% APR, making triple-digit

interest payday and car-title loans illegal. While on the one hand, payday lenders have successfully blocked

legislative efforts to enact meaningful consumer protections aimed at stopping the debt trap, on the other

hand, since 2005 no state has legalized payday lending or car title lending where it was previously prohibit-

ed. Today, 16 states plus the District of Columbia have rate caps of about 36% or less for payday loans, the

most effective protection against the debt trap.

75% of all payday loan

fees are generated from

borrowers stuck in more

than 10 loans a year.

Center for Responsible Lending Policy Brief

2

A few states—Maine, Oregon, Virginia, and Washington—have regulatory frameworks that have permitted

triple-digit interest rate loans, but with provisions that significantly curb the worst elements of the debt trap.

(See Table 3 on page 5.) For example, in 2010, Washington enacted reform establishing a limit of eight loans

in a 12-month period, leading to a 75% reduction in fees drained annually.9

At the federal level, the U.S. Department of Defense’s enhanced rules expanded the reach of the Military

Lending Act’s 36% rate cap to installment loans.10 Those rules were published in 2015 and became effective

in 2016. In October 2017, the CFPB issued a final rule covering payday and car-title loans. The leadership of

the CFPB has changed since that time. The agency has moved both to stop the rule from going into effect

and to eliminate the central element of the rule, which is the requirement that payday and car-title lenders

ensure loans are affordable to borrowers in light of their income and expenses.11

Since 2013, there have been marketplace developments, particularly in states with insufficient consumer

protections, as payday and car-title lenders have moved to longer-term loans that stretch for months

or even years.12 The updated numbers in this brief reflect another market development since the 2013

publication of State of Lending—national payday lending companies, notably Cash America and EZCorp,

have retreated from the payday loan market.13

The fee drain estimates in this brief are conservative in two ways. First, as explained in more detail in the

Methodology section below, the fees drained do not include the cost of longer-term loans in every state

where they are made. We have included fees only for states in which the data are reported to the state

regulators. Second, the fees provided here do not include penalty fees (such as late fees or bounced

payment fees) that payday lenders, car-title lenders, and banks may impose; these fees also result in

significant cost and harm to borrowers.14

Updated April 2019 3

States can enact and enforce rate caps that lower the rates

of these high-cost loans. Sixteen states and the District of

Columbia enforce rate caps of about 36% APR, ensuring

that their residents are not losing billions of dollars annually

servicing the debt of triple-digit interest rate loans.1⁵ These

rate caps provide states with the necessary tools to prevent

predatory lending practices, whether online or in a store.1⁶

Rate caps of 36%

provide states with

the necessary tools

to prevent predatory

lending.

State and Federal Policy Makers Can Stop the Debt Trap

–––––––––––––––––––––––––––––––––––––––––––––––––––––––––––––––––––––––––

The CFPB is prohibited from setting a cap on the cost of loans. As referenced above, in October of 2017,

the CFPB issued a final rule, aimed at stopping payday and car-title loans from trapping people in debt,

with the central element of the rule being the ability-to-repay requirement. In February 2019, the CFPB

issued notices of proposed rulemaking to delay the original compliance date by 15 months and to eliminate

the ability-to-repay requirement. Instead of gutting the 2017 rule, the CFPB should fully enforce the 2017

rule as written, without delay. Furthermore, in future rulemaking, the CFPB should strengthen the 2017 rule

by closing loopholes that invite evasion. These actions are needed to prevent payday loans from trapping

borrowers in debt. In addition, Congress can and should enact a federal rate cap of 36% or less, while still

allowing states to enact and enforce stronger state laws.

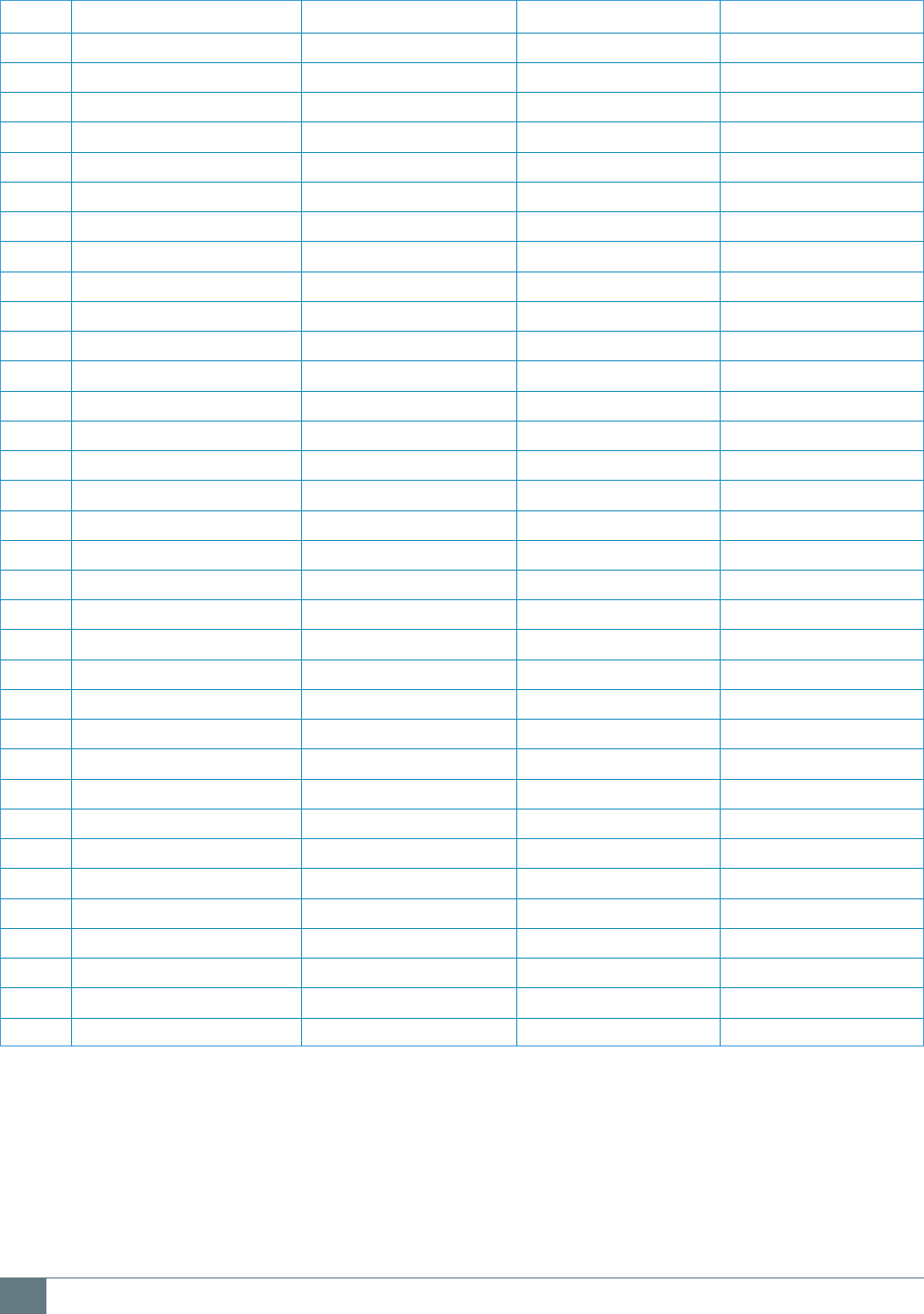

Table 1: Annual payday and car-title loan fee drain

Total payday fees Total car-title fees Total fee drain

States without debt trap protections $4,000,483,805 $3,583,894,401 $7,584,378,206

States with some debt trap protections $71,598,193 $262,585,478 $334,183,671

U.S. FEE DRAIN TOTAL $4,072,081,998 $3,846,479,879 $7,918,561,877

Center for Responsible Lending Policy Brief

4

Rank State Total payday fees Total car-title fees Total fee drain

6 Alabama $125,216,000 $356,575,005 $481,791,005

35 Alaska $5,835,235 Fees Saved $5,835,235

11 Arizona Fees Saved $254,924,519 $254,924,519

2 California $507,873,939 $239,339,250 $747,213,189

28 Delaware $520,000 $29,803,284 $30,323,284

8 Florida $311,046,128 Fees Saved $311,046,128

14 Georgia Fees Saved $199,575,563 $199,575,563

36 Hawaii $3,281,179 Fees Saved $3,281,179

21 Idaho $30,807,055 $65,414,558 $96,221,613

4 Illinois $270,204,194 $233,259,868 $503,464,062

22 Indiana $70,632,672 Fees Saved $70,632,672

26 Iowa $31,703,136 Fees Saved $31,703,136

18 Kansas $65,437,680 $45,769,329 $111,207,009

17 Kentucky $117,790,366 Fees Saved $117,790,366

13 Louisiana $145,665,345 $95,796,270 $241,461,615

20 Michigan $103,827,786 Fees Saved $103,827,786

31 Minnesota $10,580,342 Fees Saved $10,580,342

3 Mississippi $229,196,714 $297,500,639 $526,697,353

9 Missouri $109,028,334 $200,107,764 $309,136,098

29 Nebraska $28,173,908 Fees Saved $28,173,908

15 Nevada $77,725,835 $104,843,696 $182,569,531

27 New Hampshire Fees Saved $30,523,046 $30,523,046

25 New Mexico $3,700,000 $29,865,374 $33,565,374

34 North Dakota $6,863,350 Fees Saved $6,863,350

5 Ohio17 $184,461,756 $318,256,497 $502,718,253

23 Oklahoma $52,653,967 Fees Saved $52,653,967

33 Rhode Island $7,551,275 Fees Saved $7,551,275

12 South Carolina $57,773,701 $187,334,928 $245,108,629

7 Tennessee $176,249,373 $226,638,410 $402,887,783

1 Texas $1,240,697,188 $432,068,934 $1,672,766,122

16 Utah $7,880,486 $133,582,577 $141,463,063

19 Wisconsin $8,439,931 $102,714,890 $111,154,821

32 Wyoming $9,666,930 Fees Saved $9,666,930

FEE DRAIN TOTAL $4,000,483,805 $3,583,894,401 $7,584,378,206

Table 2: Annual payday and car-title loan fee drain in states without debt trap protections

Updated April 2019

5

Methodology

–––––––––––––––––––––––––––––––––––––––––––––––––––––––––––––––––––––––––

Table 3: Annual payday and car-title loan fee drain in states with some debt trap protections against the

payday loan debt trap

Rank State Total payday fees Total car-title fees Total fee drain

37 Maine $573,300 Fees Saved $573,300

30 Oregon $6,581,203 $10,106,902 $16,688,105

10 Virginia $18,729,551 $252,478,576 $271,208,127

24 Washington $45,714,139 Fees Saved $45,714,139

FEE DRAIN TOTAL $71,598,193 $262,585,478 $334,183,671

In reporting the costs of payday and car-title loans, we relied primarily on data the respective state

regulator made available. When regulator data were not available, cost estimates for loans are based on

the same methodology as our 2013 State of Lending reports,18 using an updated count of storefronts as of

the latest date for which the data are available.

Our figures include fee totals for both balloon payment loans and longer-term loans wherever data were

available. In states where payday and car-title lenders make both balloon payment and longer-term

loans, but data on longer-term loans are not reported, this analysis includes estimates for fees drained

only by balloon payment loans. This results in a more conservative estimate.

Overall fee totals may differ from our 2013 State of Lending report, as our previous report did not include

fees from longer-term installment products. In some states, the amount of fees drained by longer-term

payday and car-title loans is directly reported to the state regulator. These states are Illinois and Texas for

payday loans. For car-title loans, these states are California, Illinois, New Mexico, Texas, and Virginia.

Our figures also include states not covered in our State of Lending report on payday loans. For example,

Delaware and Ohio enacted legislation to stop the debt trap, yet since then lenders have circumvented

state law to continue to drain millions in fees from consumers. Although Delaware enacted a limit of five

payday loans in a 12-month period, payday lenders have largely evaded the provision by moving into

longer-term payday loans. The amount reflected in this report is for fees drained by lenders operating

under the provision of five payday loans in a 12-month period. In Ohio, even though the voters affirmed

a 28% rate cap for payday loans in 2008, payday and car-title lenders persistently evaded it. This paper

shows the fee drain caused by that evasion. A new law is set to go into effect in Ohio in April 2019, and

additional monitoring will be needed to determine how this impacts the market. This brief is the first

time we are reporting state-by-state estimates for car-title fees.

Center for Responsible Lending Policy Brief

6

1 Consumer Financial Protection Bureau (CFPB). (2013). Payday loans and deposit advance products: A white paper of initial

data findings. http://1.usa.gov/1aX9ley

2 Ibid.

3 Ibid.

4 Ibid.

5 Coleman, B., and Davis, D. (2016), Perfect Storm. Center for Responsible Lending. http://www.responsiblelending.org/sites/

default/les/nodes/les/research-publication/crl_perfect_storm_orida_mar2016.pdf

6 Fox, J.A., Feltner, T., Davis, D., and King, U. (2013). Driven to disaster: Car-title lending and its impact on consumers. Center for

Responsible Lending and Consumer Federation of America. http://bit.ly/17GAEeu

7 Ibid.

8 Montezomolo, S. (2013). State of Lending: Payday Lending Abuses and Predatory Practices, Center for Responsible Lending,

http://responsiblelending.org/sites/default/files/uploads/10-payday-loans.pdf and, Montezomolo, S. (2013). State of Lending:

Car-title Lending. Center for Responsible Lending. http://www.responsiblelending.org/state-of-lending/reports/7-Car-Title-Loans.

pdf

9 In 2009, payday lenders in Washington drained $183,437,279 in fees. In 2014, according to the Washington Department of

Financial Institutions, payday lenders drained $45,714,139 in fees.

10 Limitations on Terms of Consumer Credit Extended to Service Members and Dependents, 80 FR 43559 (July 22, 2015) (to be

codified at 32 C.F.R. pt. 232). https://www.federalregister.gov/documents/2015/07/22/2015-17480/limitations-on-terms-of-con-

sumer-credit-extended-to-service-members-and-dependents

11 Consumer Financial Protection Bureau (CFPB). (Feb 2019). Consumer Financial Protection Bureau Releases Notices of Proposed

Rulemaking on Payday Lending. https://www.consumerfinance.gov/about-us/newsroom/consumer-financial-protection-bureau-

releases-notices-proposed-rulemaking-payday-lending/

12 Carter, C. et al. (2015). Installment Loans: Will State Laws Protect Against the Next Wave of Predatory Loans? National Consumer

Law Center. http://www.nclc.org/images/pdf/pr-reports/report-installment-loans.pdf. See also, Smith, P. and Standaert, D. (2015)

Payday and Car-Title Lenders Move into Unsafe Installment Loans. Center for Responsible Lending. http://www.responsiblelending.

org/other-consumer-loans/car-title-loans/research-analysis/crl_brief_cartitle_lenders_migrate_to_installmentloans.pdf

13 Hammond, E. (2016). First Cash to Buy Cash America in $994 Million Pawn Deal. Bloomberg (noting “Cash America and First

Cash both have retreated from payday lending to focus on pawnbroking.”). http://www.bloomberg.com/news/arti-

cles/2016-04-28/rst-cash-to-buy-cash-america-for-994-million-in-pawn-deal and EZCORP. (2015). EZCORP Announces New

Strategy, Structure and Business Focus. https://globenewswire.com/news-release/2015/07/29/756133/0/en/EZCORP-Announces-

New-Strategy-Structure-and-Business-Focus.html

14 Consumer Financial Protection Bureau (CFPB). (2016). Online Payday Loan Payments http://les.consumernance.

gov/f/201604_cfpb_online-payday-loan-payments.pdf. See also, Montezomolo, S. and Wolff, S. (2015). Payday Mayday: Visible

and Invisible Payday Lending Defaults. Center for Responsible Lending. http://www.responsiblelending.org/payday-lending/

research-analysis/nalpaydaymayday_defaults.pdf

15 Arizona, Arkansas, Colorado, Connecticut, District of Columbia, Georgia, Montana, New Hampshire, New York, New Jersey,

North Carolina, Maryland, Pennsylvania, South Dakota, Vermont, and West Virginia.

16 Coleman, B. and Standaert, D. (2015). Ending the Cycle of Evasion: Effective State and Federal Payday Lending Enforcement,

Center for Responsible Lending. http://www.responsiblelending.org/payday-lending/research-analysis/crl_payday_enforce-

ment_brief_nov2015.pdf

17 At the end of April 2019, a new payday law will go into effect in Ohio. While we anticipate that the law is likely to reduce the

fee drain, payday lenders will still be able to trap Ohioans in triple-digit APR debt traps. For more information, view Standaert,

D. (2018) Policy Brief: What Happened with Payday Loans in Ohio? http://bit.ly/2MQzWW5

18 Montezomolo, S. (2013). State of Lending: Payday Lending Abuses and Predatory Practices, Center for Responsible Lending,

http://responsiblelending.org/sites/default/les/uploads/10-payday-loans.pdf and, Montezomolo, S. (2013). State of Lending:

Car-Title Lending. Center for Responsible Lending. http://www.responsiblelending.org/state-of-lending/reports/7-Car-Title-

Loans.pdf

Endnotes

–––––––––––––––––––––––––––––––––––––––––––––––––––––––––––––––––––––––––

Updated April 2019

7

North Carolina

302 West Main Street

Durham, NC 27701

Ph (919) 313-8500

Fax (919) 313-8595

Copyright © 2019 by Center for Responsible Lending

California

1970 Broadway

Suite 350

Oakland, CA 94612

Ph (510) 379-5500

Fax (510) 893-9300

District of Columbia

910 17

th

Street NW

Suite 500

Washington, DC 20006

Ph (202) 349-1850

Fax (202) 289-9009

www.responsiblelending.org

The Center for Responsible Lending (CRL) is working to ensure a

fair, inclusive financial marketplace that creates opportunities for

all responsible borrowers, regardless of their income, because too

many hard-working people are deceived by dishonest and harmful

lending practices.

CRL is a nonprofit, non-partisan organization that works to protect

homeownership and family wealth by fighting predatory lending

practices. Our focus is on consumer lending: primarily mortgages,

payday loans, credit cards, bank overdrafts, and auto loans.